- Market volatility is at high levels: Bitcoin price swings likely to continue.

- A break above $10,000 could give bitcoin a boost towards $11,000.

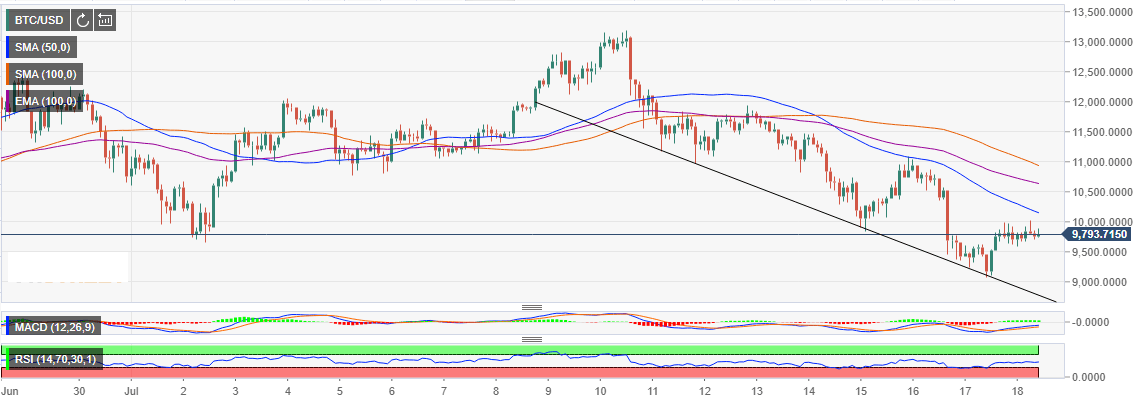

Bitcoin rollercoaster rides are at their full throttle and paint a picture of extreme volatility levels. As FXStreet reported, the slump from highs slightly above $11,000 explored levels marginally above $9,000 on Wednesday before recovery ensued.

While the bounce has brushed shoulders with $10,000, most experts are not convinced that the bear pressure has been overwhelmed. In fact, the failure to break above $10,000 is a key indicator of the bulls getting exhausted. Prior to the bounce, FXStreet had predicted that Bitcoin would breakdown further to $8,800 and even extend the losses to $8,500. This analysis still stands as long as Bitcoin price remains under $10,000.

Also Read: Coinshares: Bitcoin and Libra are primarily different

The technical picture at the moment is slightly bullish with enough buying power to sustain Bitcoin between $10,000 and $9,500 limits. Looking at the Moving Average Convergence Divergence (MACD) we see the buyers gaining momentum gradually against the bears. However, the Relative Strength Index (RSI) is moving sideways at the average (50) to show that sideways trading is the most likely trend in the short-term.

On the other hand, a break above $10,000 could give bitcoin a boost towards $11,000 in the medium-term. Besides, trading above the moving averages could also be a good indicator for further growth.