- Bitcoin has roughly the number of users the Internet had in 2005.

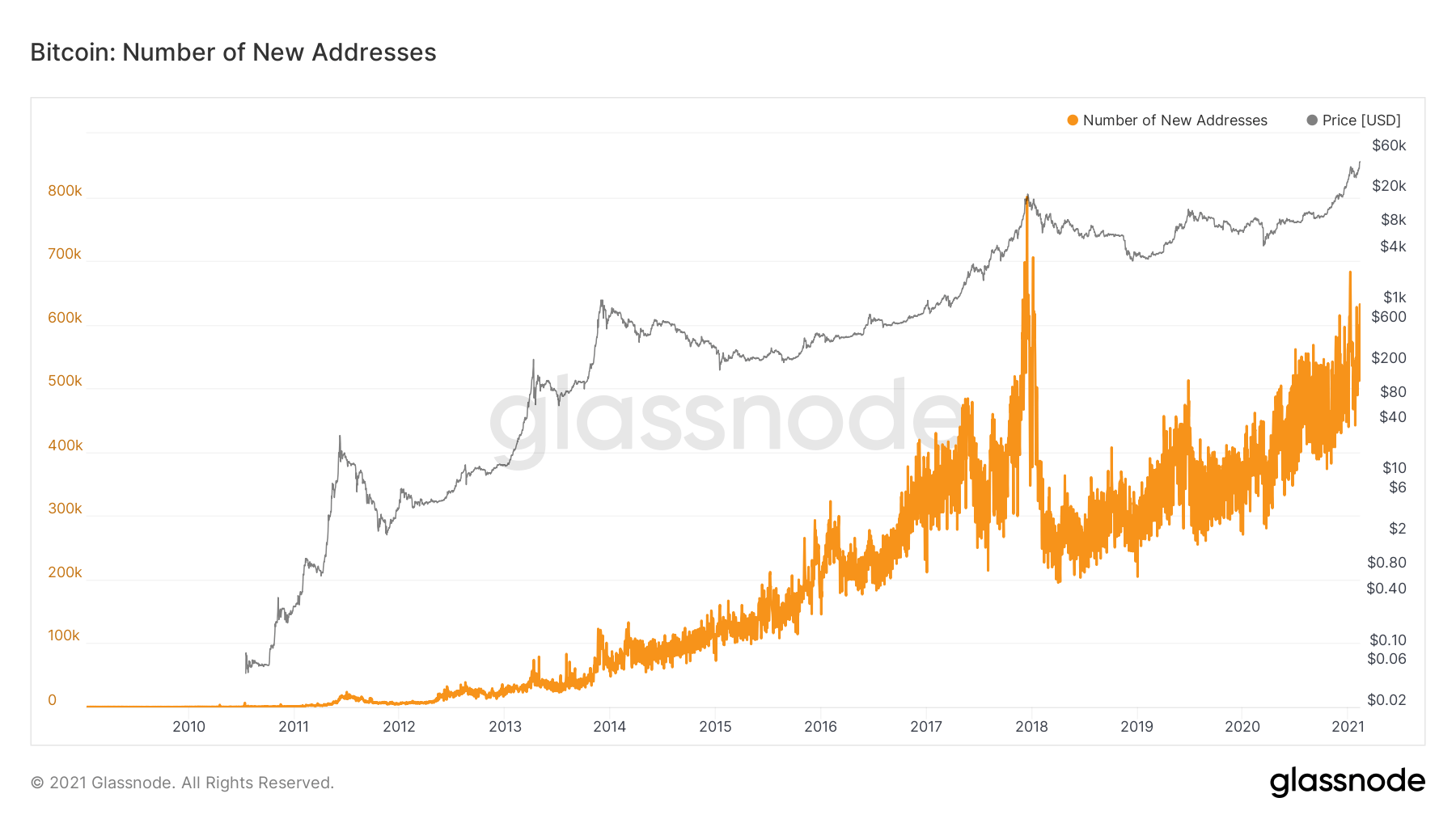

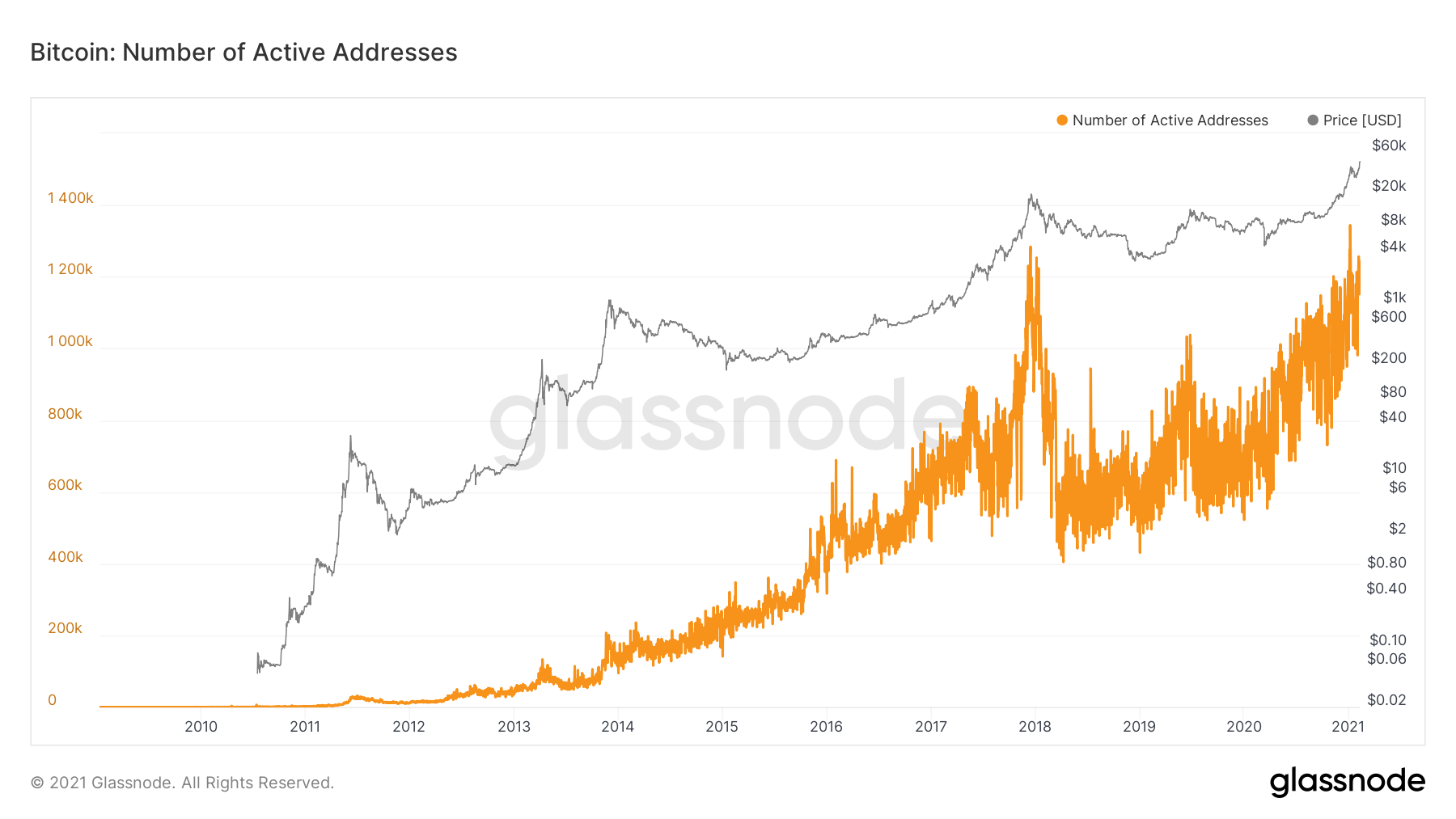

- The adoption of BTC is reflected by the number of unique and active addresses on the network.

- Leading global companies like Tesla, MicroStrategy and Square are leading the adoption of Bitcoin.

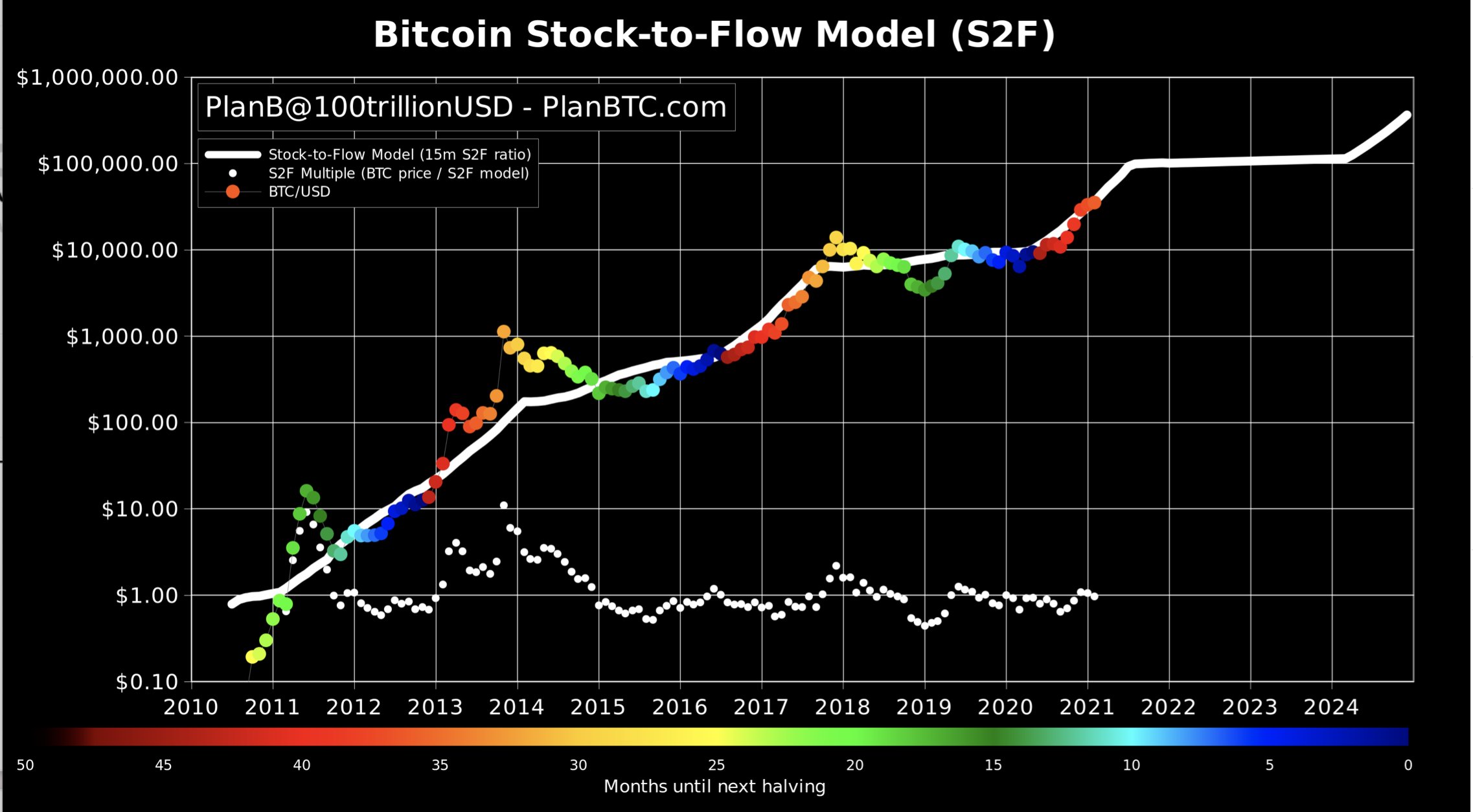

- The S2F model popularized by PlanB predicts that Bitcoin will soar to $100,000 by the end of 2021.

Bitcoin has, from its inception, been compared to the revolutionary growth of the internet. This growth has been not only exponential but also rapid in the 21st century. The internet explosion opened the door to increased research, development as well as investment in telecommunication services such as optical fiber.

History of the internet and its growth

Mass adoption of the internet began in 1994 when governments decided to expand its usage to individuals and private entities. Like Bitcoin and blockchain technology, the internet developed a platform that revolutionized business operations and communication. Towards 2,000, internet growth doubled every year, which introduced the notion that the world was a “global village.”

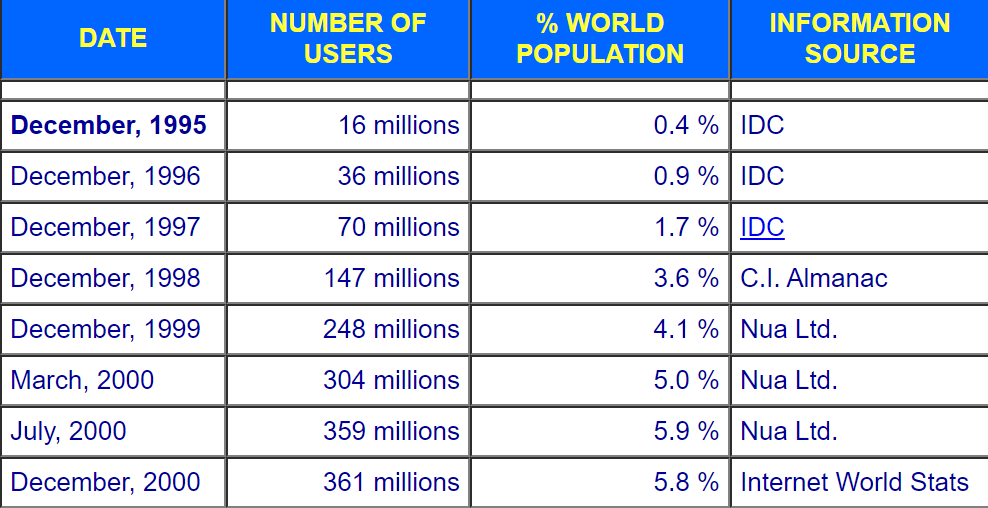

According to International Data Corporation (IDC), 16 million people were connected to the Internet by 1995, representing 0.4% of the world’s population. Five years later, 2,000, the internet ballooned to connect a whopping 361 million users, making 5.8% of the global population.

Growth of the internet until 2000

Consequently, the Internet World Stats shows that the decade ending in 2010 was the best thing that ever happened to the Internet, with the number of users growing to 1,971 million. The 81.7% growth was boosted by mass adoption due to the improvement in technology, especially smartphones’ introduction. By the end of 2010, 28.8% of the global population was connected to the internet.

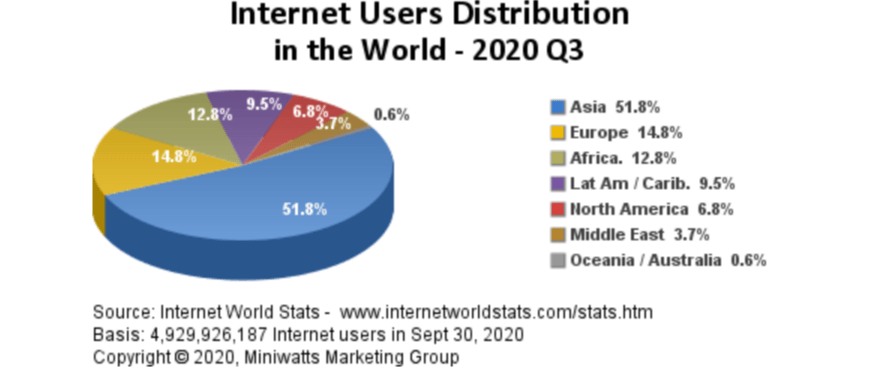

The number of users on the internet more than doubled during the decade ending 2020. Nearly 4,800 million users had access to the Internet by the end of 2020, representing 62% of the world’s population, according to the Internet World Stats data.

Currently, the Internet has 4,949 million users, following a minor upswing from the figure in 2020. In other words, 63.2% of the global population is on the web. Notably, from 2,000 to 2020, the Internet grew by 1,271%.

Current internet users’ distribution

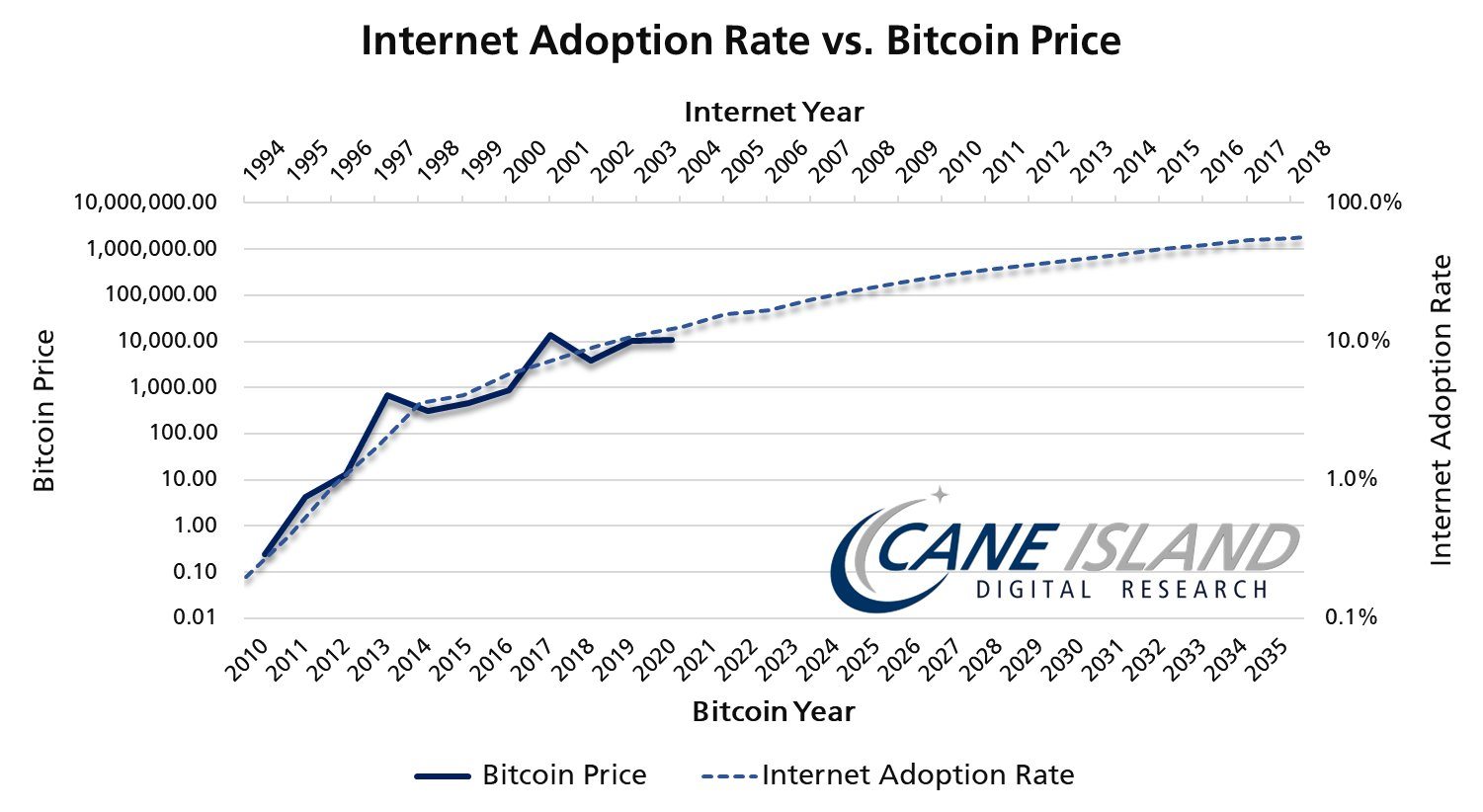

How Bitcoin mass adoption is growing in relation to the Internet

The Internet has been around much longer than Bitcoin. However, the adoption of the pioneer cryptocurrency and the underlying technology, blockchain, seems to be outdoing the internet’s mass adoption.

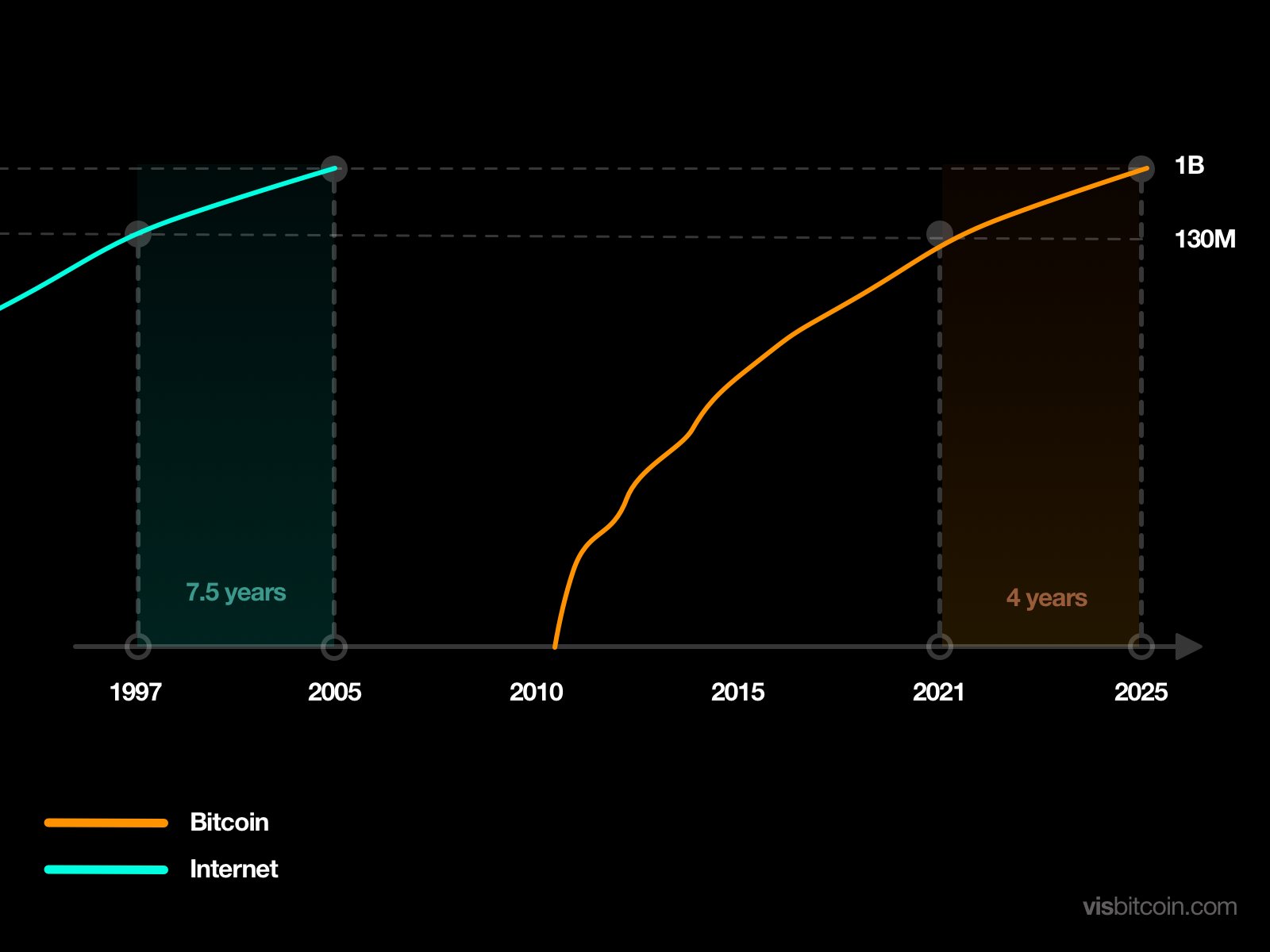

Bitcoin vs. internet adoption curve

As far as adoption is concerned, Bitcoin had approximately the same number of users as the Internet in 1997. However, Bitcoin’s mass adoption is growing at a faster rate when compared to the Internet. It is projected that in the next four years, Bitcoin will have around 1 billion users.

Bitcoin 4-year projected growth

Bitcoin network exponential growth

The number of new addresses joining the Bitcoin network illustrates how fast BTC is reaching mass adoption. For instance, Glassnode’s on-chain metrics show that newly-created addresses soared from roughly 60 to 610,000 at the peak of the bull run in 2017. At the time of writing, the network growth is increasing by approximately 560,000 per day.

Bitcoin network growth

Consequently, another critical indicator of Bitcoin’s exponential mass adoption is the number of active addresses. The on-chain metric from Glassnode tracks the unique addresses working as senders or receivers. Glassnode only includes the addresses that were active in successful transactions. The chart below highlights consistent growth since 2009 from zero to the prevailing 1.2 million addresses.

Bitcoin number of active addresses

Bitcoin price growth

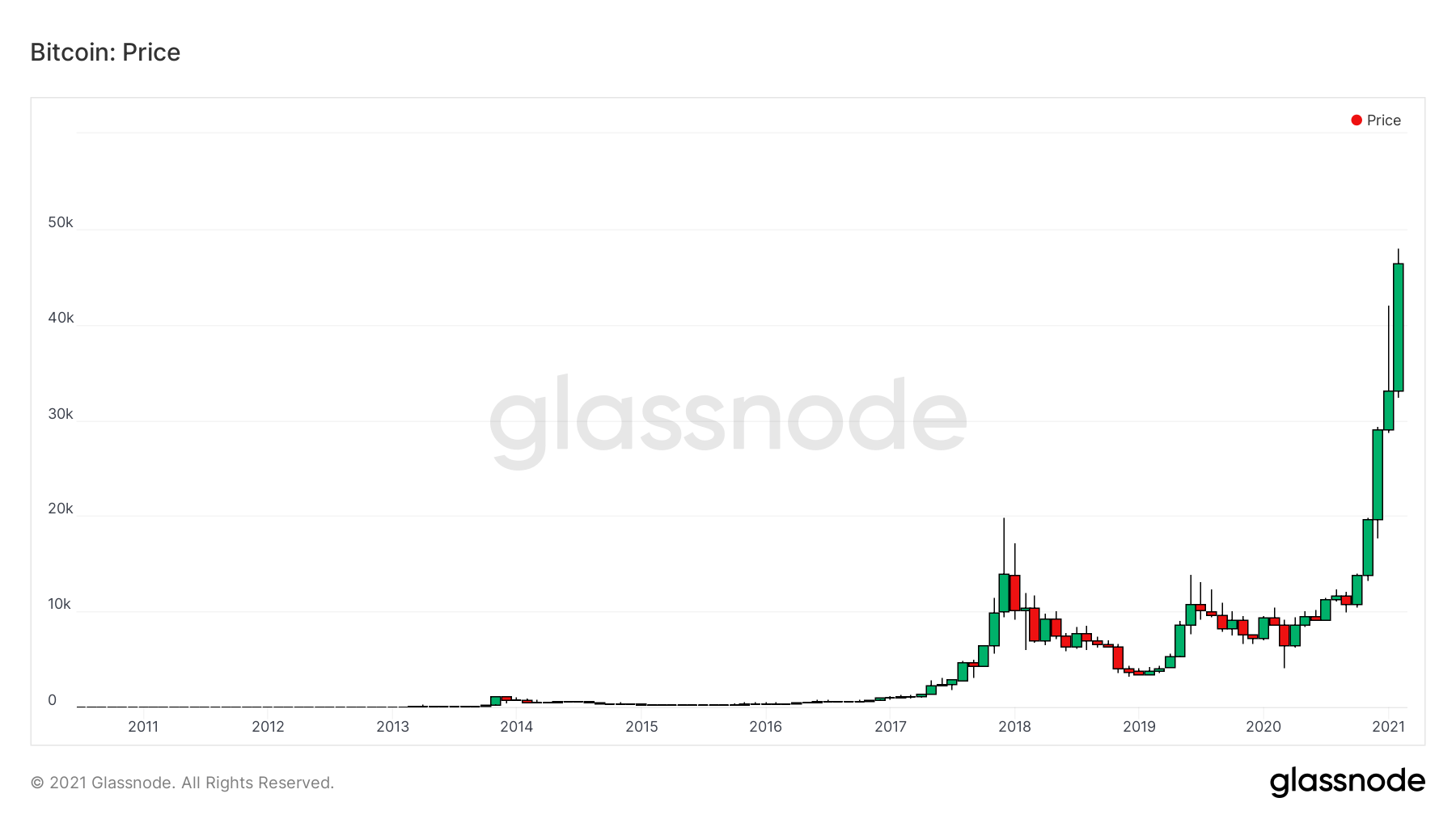

The flagship cryptocurrency remains an exceptional asset regarding the increase in value. The bull run in 2017 saw the birth of many critics, including leading governments around the world, financial institutions and influential individuals. Bitcoin was branded the 21st-century bubble following the rally to $20,000 and the freefall to price levels around $3,800 in 2019.

Nonetheless, the bellwether cryptocurrency has risen above the criticism to explore new record highs close to $50,000. The founder of Galaxy Digital, Michael Novogratz, believes that BTC is on the way to hitting $100,000 by the end of 2021, as leading companies add it to their balance sheets.

Bitcoin price chart

The Stock-to-Flow model popularized by a prominent analyst called PlanB projects that one Bitcoin will be exchanged at $100,000. The model’s prediction for 2020 came to pass and Bitcoin is on the road to hitting the next target. Mass adoption will mainly support this growth alongside the halving event that sees Bitcoin supply levels reduced significantly.

Bitcoin S2F model

Bitcoin adoption by public-traded companies

Institutional investment in Bitcoin has been attributed to the increase in price over the years. Some of the most prominent and public traded companies having BTC on their balance sheets include MicroStrategy (with over $1 billion worth in the crypto asset), Square with their known support for Bitcoin using the Cash App, Galaxy Digital Holdings (16,400 BTC), Hut 8 Mining, a Canadian mining company and Voyager Digital.

Tesla, the company founded by Elon Musk, recently announced that it had bought Bitcoin worth $1.5 billion. Moreover, customers have been allowed to buy its electric vehicles using BTC as a form of payment. The adoption by companies is set to continue, especially if the bull run continues in 2021.

Why Bitcoin threatens the global financial system

Bitcoin is a decentralized currency not tied to any overseeing body like the world’s fiat currencies that central banks control. As Bitcoin grows, there is a paradigm shift of global money into the digital system.

In other words, central banks could have less control over the global supply of money. At the same time, inflation in Bitcoin is minimal and the icing of the cake is that a halving event takes place every four years to keep it in check.

The European Central Bank has recently blasted BTC for being extremely volatile. The regulator alleges that Bitcoin supports money laundering and other unwanted activities. However, the pioneer cryptocurrency continues to grow both as an asset and a medium of exchange, especially with companies like Tesla diving in to take a piece of the cake.

Bitcoin mass adoption is growing fast compared to the Internet, as discussed above. The growth is also connected with the increase in value over the years. As BTC price nears $100,000, the uptake of Bitcoin is likely to soar towards 1 billion even before 2025.