- Bitcoin consolidates the recovery to 7,400 levels on Saturday.

- BTC bears remain on track to book a 15% weekly loss.

Bitcoin (BTC/USD), the most widely traded cryptocurrency, extends the overnight consolidative mode around 7,250 region, as a tug of war between the bulls and bears persists so far this Saturday.

The no. 1 coin hit fresh half-yearly lows of 6,787 in Friday’s European session, in what was seen as a massive slaughter of the BTC bulls. From there, Bitcoin attempted a steady recovery towards the 7,400 levels but the bulls lost strength just shy of the last. Despite the comeback, the spot is down nearly 5% over the last 24 hours and on its way to book a 15% weekly loss. Its market capitalization now stands at $ 131.37 billion or 66.30% of total crypto market capitalization.

Technical overview

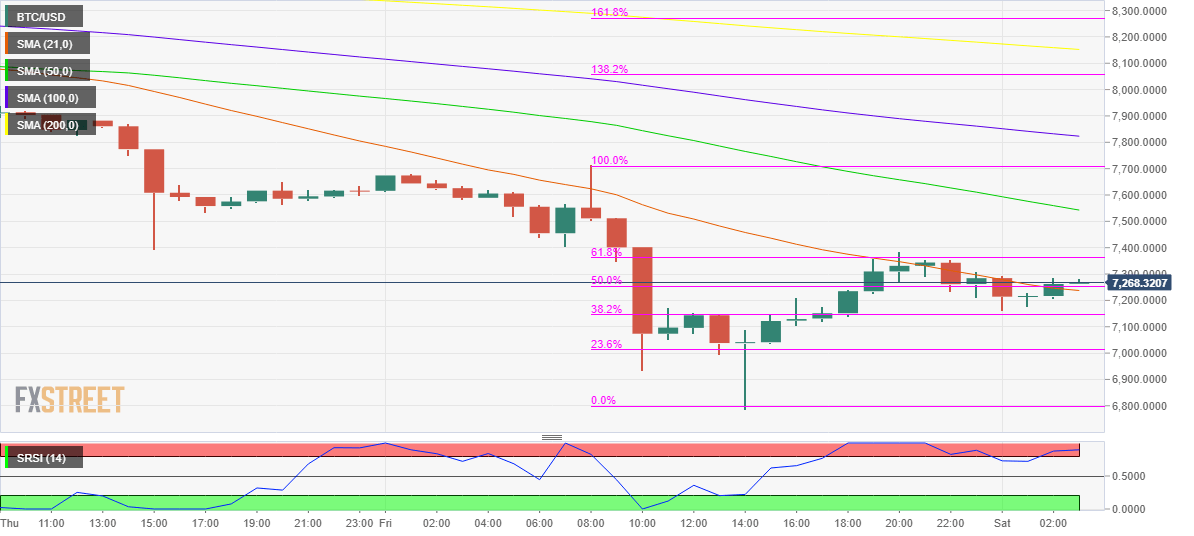

The spot has paused its five-day losing streak, although the bearish bias still remains intact, as the price still trades below most major hourly Simple Moving Averages (HMA). Moreover, the recovery continues to face stiff resistance at the 61.8% Fibonacci Retracement (Fib) level of Friday’s slump, placed near 7,365 region, leaving the coin wavering in a narrow range over the last hours. Further, the hourly Relative Strength Index (RSI) is lying in the overbought territory, suggesting that the buyers may have faced exhaustion. Only a sustained break above the 7,365-7,400-supply zone could revive the recovery, with the downward sloping 50-HMA at 7,542 seen as the next upside barrier. On a break beyond the last, bulls would again confront the 7,700 mark, the level from where the downpour began a day before.

On the flip side, the 38.2% Fib level of the latest declines at 7,147 could cap the immediate downside. Sellers will return with pomp and show should the bulls fail to resist the afore-mentioned support, opening floors for a retest of the 7,000 level en-route the six-month lows sub-6,800 handle.

All in all, it appears for now that the bears are gathering pace before the next push lower.

BTC/USD 1-hour chart

BTC/USD Levels to watch