- BTC bears regain control as $29,500 support beckons.

- Lack of healthy support levels favor the sellers on Saturday.

- Recapturing $33,479 is needed to keep the buyers alive in the game.

After almost a down week, Bitcoin (BTC/USD) witnessed a dead cat bounce Friday, although the sellers returned this Saturday amid a fresh selling-wave seen across the cryptos space.

The most favorite digital asset is down nearly 4.50%, pressuring $31,500, as of writing. The coin failed to find acceptance above the $33K mark, prompting the bears to take over control.

How Bitcoin is positioned on the technical graphs?

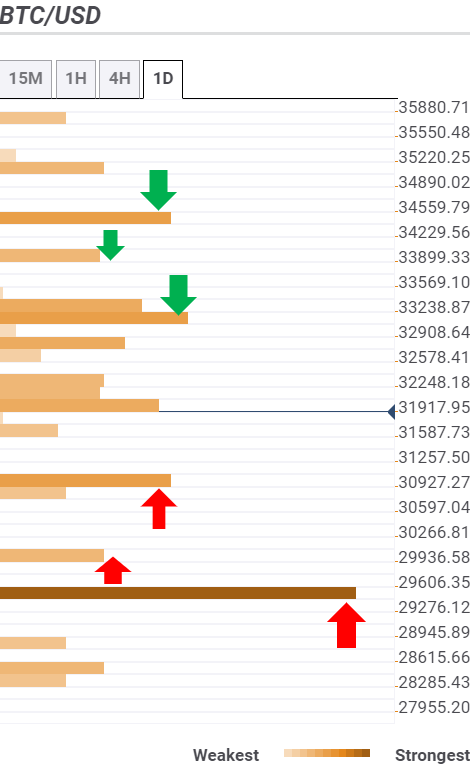

The Technical Confluences Indicator shows that the price is accelerating its decline towards the critical support at $29,500, which is the convergence of the previous month and year high.

En-route the abovementioned powerful cap, the BTC bears could challenge a soft cushion aligned at $31,100. That level is the intersection of the Fibonacci 23.6% one-week and Bollinger Band one-day Lower.

A breach of the last could threaten the $29,800 level, opening floors towards the $29,500 downside target.

Alternatively, the BTC bulls need to find acceptance above the intraday highs of $33,479 to refuel the recovery momentum. This is the point where the Bollinger Band four-hour Middle and pivot point one-month R1 also meet.

The next upside barrier is seen just above the previous day high. At $34,100, the SMA100 one-day lies.

The confluence of the SMA5 one-day and Fibonacci 61.8% one-week at $34,350 could challenge the bulls’ commitment, as the No.1 coin looks to the $40K barrier once again.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence