- Bitcoin resumes the uptrend heading to $6,500 after the dip to $6,350.

- The medium-term resistance at $6,500 is within reach but 38.2 resistance must be cleared first.

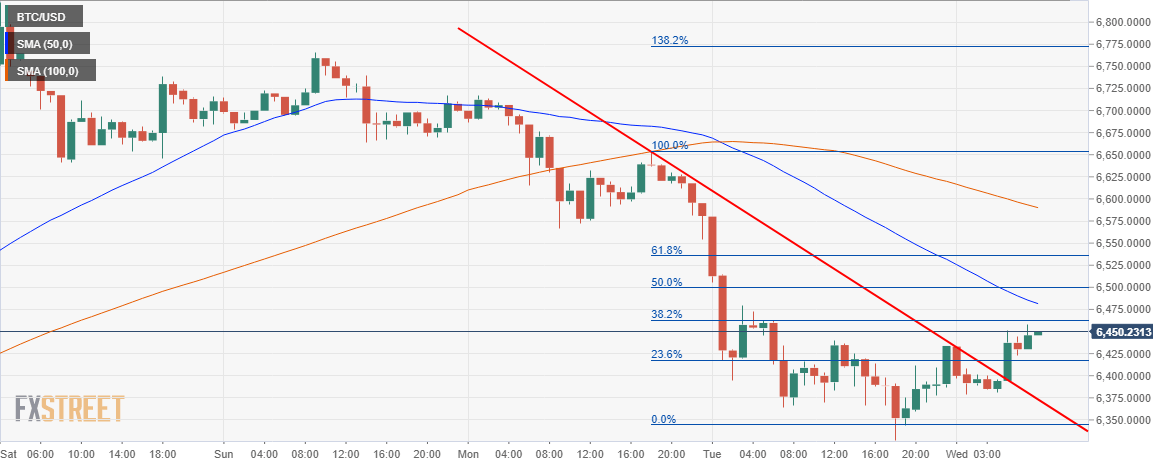

Bitcoin is making a comeback in the wake of the consolidation following the declines that began on Monday. There is a subtle 0.16% rise on Wednesday. In addition, the price has jumped above the short-term trendline resistance on the hourly timeframe chart.

The declines on Tuesday saw Bitcoin say hello to $6,300 while bidding $7,000 bye-bye. However, the buyers were not ready to deflate anymore and battled to find bearing at $6,350. Significantly, as shared yesterday on FXStreet, a China VC said that the bear market for Bitcoin has come to end. He reckoned that the largest cryptocurrency by market capitalization is ready to make an incredible comeback in the fourth quarter of 2018. Altcoins, on the other side, have to wait for another 200 days for their bear market to end according to the China VC.

Meanwhile, Bitcoin is trading at $6,449 at the time of press. The buyers are looking forward to $6,500, but first they must clear the resistance at the 38.2% Fib retracement level with the last high leg of $6,655.35 to a swing low of $6,345.38. Likewise, the hourly 100SMA currently at $6,482.27 will hinder growth towards the medium-term resistance at $6,500.

On the flipside, there is a weak support established at $6,400 – $6,375 but yesterday’s turning point at $6,350 is strong enough to prevent declines heading to $6,300.

BTC/USD hourly chart