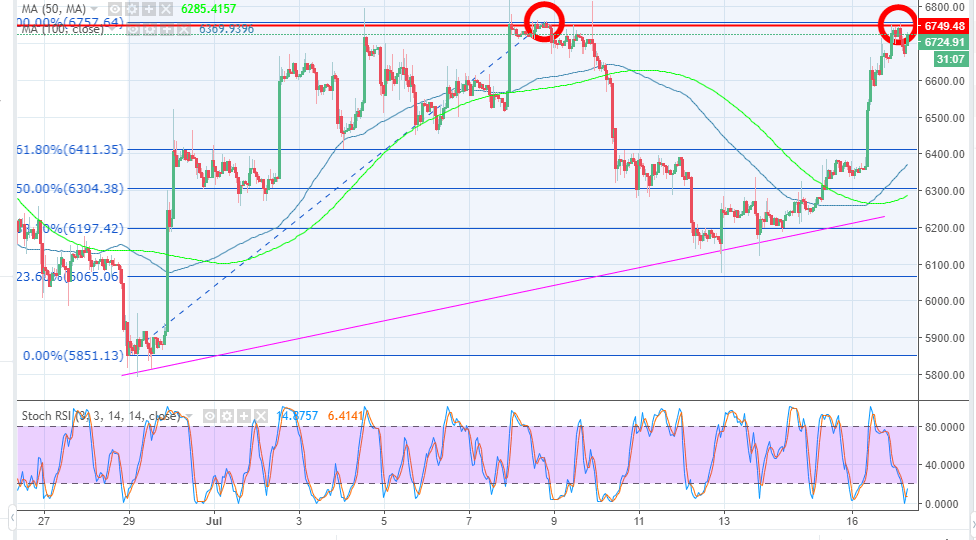

BTC/USD reclaimed $6,600 and even traded above $6,700.

Critical resistance is at $6,800 ahead of the long-term key hurdle at $7,000.

“No. I don’t think that any client has sought out crypto exposure”¦” said BlackRock’s CEO.

Bitcoin price led a recovery trend during the trading on Monday. Most of the digital assets corrected higher breaking stubborn resistance barriers that had been limiting upside gains since the overarching declines last week. Bitcoin price surged over 5% in less than two hours after breaking the resistance at $6,400. BTC/USD reclaimed $6,600 and even traded above $6,700 on Monday Evening.

The price movement has formed a double-top pattern as observed on the 1-hour timeframe chart. However, the trend is bullish at the moment and BTC/USD is pushing for further corrections. There is immediate resistance to be faced at $6,750, but the critical resistance is at $6,800 ahead of the long-term key hurdle at $7,000.

Bitcoin price is trading above $6,700 at the time of writing, while a support above this level is essential to the buyers. On the flipside, in case of declines persist, $6,600 is another support area while the former resistance at $6,400 will work as an anchor too.

News that BlackRock; a popular investment management company is looking cryptocurrencies as an investment is believed to have ignited the bullish trend on Monday 16. As the story unfolded in the mainstream media, it is apparent that the news was just but a rumour. The CEO of BlackRock came out later on Monday to clarify that his company has considered the blockchain technology but not digital assets per say.

Larry Fink, BlackRock’s CEO noted that the clients at the firm have not expressed a “huge demand for cryptocurrencies,” unlike what the media had reported. Larry made his comments during an interview with Reuters as well as with Bloomberg on Monday. While responding a question of whether clients at the company wanted cryptocurrency exposure, Fink said:

“No. I don’t think that any client has sought out crypto exposure”¦ I’ve not heard from one client who says, ‘I need to be in this.”