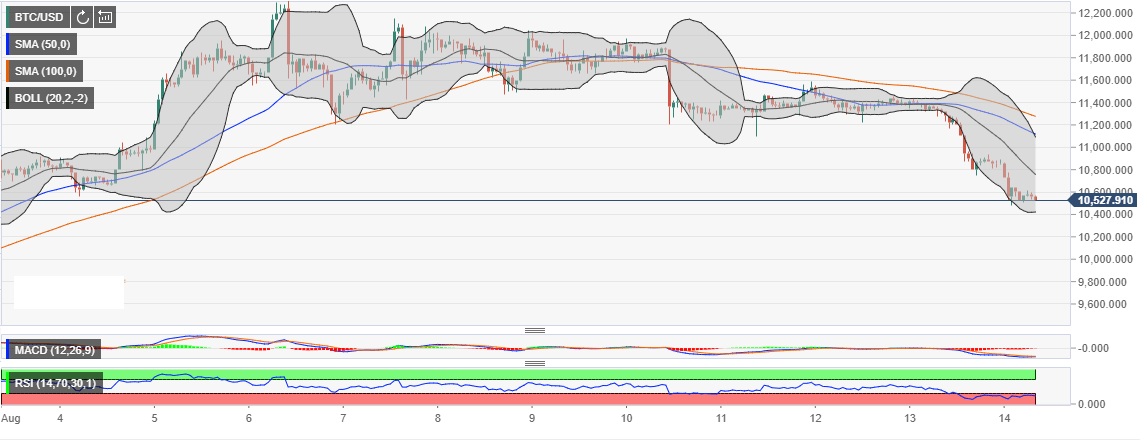

- The Bollinger Band constriction reached its elastic limit further fueling Bitcoin drop.

- BTC/USD smashed past $10,500 support before forming a low at $10,484.

- Bitcoin is exchanging hands at $10,540 amid larger market indecision.

Bitcoin ravaged through the support at $11,000 yesterday as a reaction to the relief in the financial markets. Another asset that suffered is gold as it dumped over 0.6% to trade around $1,500. The two assets have been regarded as reliable hedgers against the stock market that has been taking the heat from the trade war between the United States and China.

Looking at the hourly chart, the Bollinger Band constriction reached its elastic limit. This gave brought to an end the consolidation of BTC above $11,200. The above negative catalyst gave the bears confidence as they tightened their grip on the price.

Overwhelming selling pressure pushed Bitcoin off balance as it plunged under $11,000. The price thrust through $10,800 support areas. Moreover, BTC/USD smashed past $10,500 support before forming a low at $10,484.

At press time, Bitcoin shallow recovery has pushed it above $10,500. Bitcoin is exchanging hands at $10,540 amid larger market indecision. The capacity to defend the support at $10,500 will determine the retracement above $11,000. Technicals, on the other hand, point towards increasing selling pressure.

Both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are sending out negative signals. Therefore, we can expect Bitcoin to stay above $10,400, however, a correction towards $11,000 will take longer.

BTC/USD 1-hour chart