- Bitcoin is holding tight at the edge of a cliff marginally above $7,000.

- Goldman Sachs abandons plans to open a crypto desk citing regulatory landscape.

The crypto market is beast, it acts like it pleases and does not care to give explanations. It leaves experts trying to demystify the causes of its actions. For instance, the recent bull rally occurred independently of the Bitcoin exchange-traded funds (ETF) proposals denial by the US Security and Exchange Commission (SEC). However, the authority later said that it will review the denied ETFs at a later but unspecified date. Later this month, the regulatory is expected to rule on another Bitcoin ETF that was pushed to September 30.

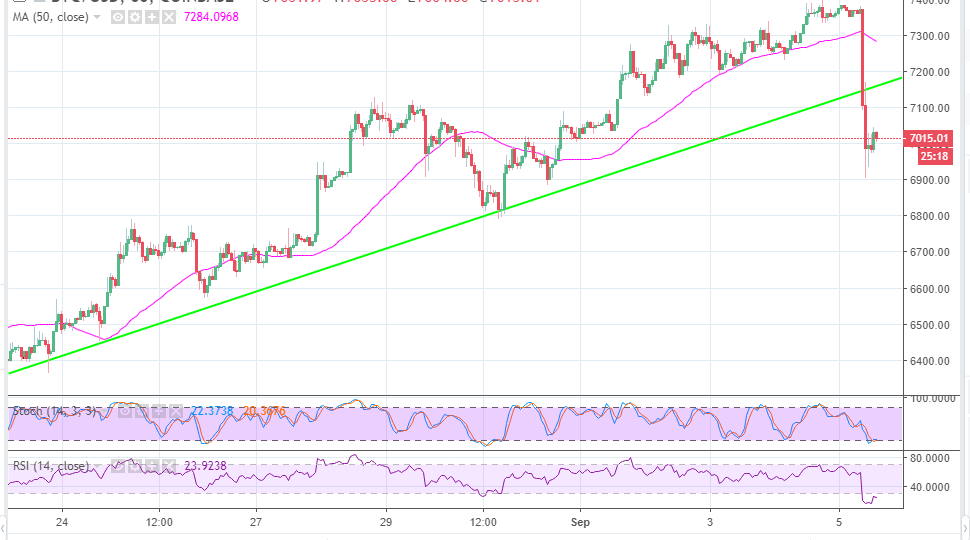

Consequently, Bitcoin continued with its rally above $6,400 and broke above $7,000. Moreover, there was a retracement that came close to $7,400 yesterday. Unfortunately, today has been tough on the digital assets. Bitcoin has corrected lower below $7,000 creating a monthly low at $6,901.03. The decline comes after Goldman Sachs abandoned plans to build a cryptocurrency desk as reported by Business Insider. The financial guru is citing tough regulations surrounding virtual currencies but this is not the end of it all, the plans could be revamped in the future.

Bitcoin has pulled back above $7,000, but it is not clear of further breakdown just yet. A strong support must be established above $7,000 and recoil above $7,100 could increase buyers’ morale towards $7,300 and $7,400 in the medium-term. The defended support at $6,900 will continue holding ground, similarly, August support at $6,800 and $6,400 will come in handy.

BTC/USD 1-hour chart