- BTC/USD clinches to an important support area.

- A move above $5,350 will mitigate initial bearish pressure.

Bitcoin (BTC) is hovering around $5,200 handle amid shrinking volatility. The first digital asset tested area below $5,000 during late Thursday hours, but the strong orders located on approach to the psychological handle initiated the recovery.

From the fundamental point of view, the speculations about Tether manipulations and involvement in money-laundering schemes served as an initial catalyst for the strong sell-off across all major coins.

In a separate development, India is considering a complete ban on digital assets. The authorities ae discussing the draft bill that might be adopted following the elections in May.

Bitcoin’s technical picture

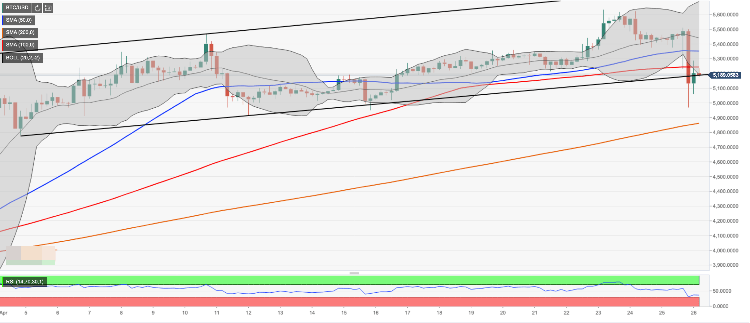

Looking technically, BTC/USD stays marginally above the critical support line, created by the lower boundary of the recent upside channel and strengthened by the lower line of 4-hour Bollinger band at $5,180. A sustainable move lower will darken the technical picture and create a pre-conditions for further sell-off towards psychological $5,000 and $4,850-60 (SMA200, 4-hour).

On the upside, we `need to see a sustainable move above $5,300 and $5,350 (SMA50 4-hour, SMA200 1-hour) to mitigate initial bearish pressure. Once this happens the focus will shift onto $5,440 barrier created by the middle line of 4-hour Bollinger Band and SMA100 1-hour.

BTC/USD, 4-hour