- BTC/USD is under strong selling pressure on Monday.

- Strong support area comes on approach to $10,000.

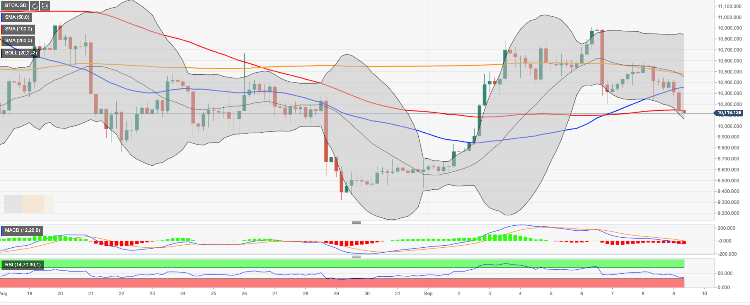

Bitcoin (BTC) started Monday with a strong sell-off. The first digital asset dropped to an intraday low of $10.083 before recovering towards $10,121 by the time of writing. BTC/USD has lost nearly 3% since the beginning of Monday and 3.6% on a day-on-day basis. Considering that the bearish sentiments remain strong we may see another assault at critical $10,000 pretty soon. Bitcoin dominance slipped to $69.8% from 71%.

Bitcoin’s technical picture

Looking technically, a sustainable move below $10,000 will worsen the technical picture significantly. Once this happens, many short-term buyers will rush to exit creating a new trigger for further decline with the next focus on $9,500 ( the lower line of 1-day Bollinger Band). However, this psychological barrier is well protected by a cluster of buy orders and the lower line of 4-hour Bollinger Band located on approach. It means that BTC bears will have a hard time pushing the price below this barrier.

On the upside, we will need to see a sustainable move above $10,350 (SMA50 (Simple Moving Average) 4-hour) to mitigate the initial pressure and allow for a further recovery towards $10,500. This area contains SMA200 4-hour and the middle line of 4-hour Bollinger Band. Once it is out of the way, the price may retest $10,800 and $10,850 strengthened by the upper line of 4-hour Bollinger Band.