- Bitcoin shows stability around $6,400 following a retracement from $6,450.

- Bitcoin drops significantly in the latest Chinese blockchain rankings.

There has been a period of low volatility in the market, especially in October. The low volatility coupled with low daily transactions resulted in stability that has shocked most cryptocurrency experts, analysts and enthusiast. In fact, Tom Lee, a Wall Street turned cryptocurrency analysts recently said that he is “pleasantly surprised” by the stability shown by Bitcoin and other major cryptocurrencies.

Bitcoin was locked in an approximately $300 range during entire trading in October. The upside was limited below $6,500 while the buyers strongly defended the support at $6,200. There swings up and down the pivotal level at $6,400. Besides, the largest asset by market capitalization revamped the trend above the above-mentioned support in the first week of November.

The last weekend trading saw Bitcoin scale the highs above $6,300 making it above $6,400 before starting to deflate faintly above $6,450. Volatility appears to be returning to the market after BTC/USD added at least $117 yesterday, Sunday 4. The buyers failed to sustain the trend towards $6,500 resulting in declines that have dipped below $6,400 today. Bitcoin is down 0.35% on the day and has traded lows of $6,387.97.

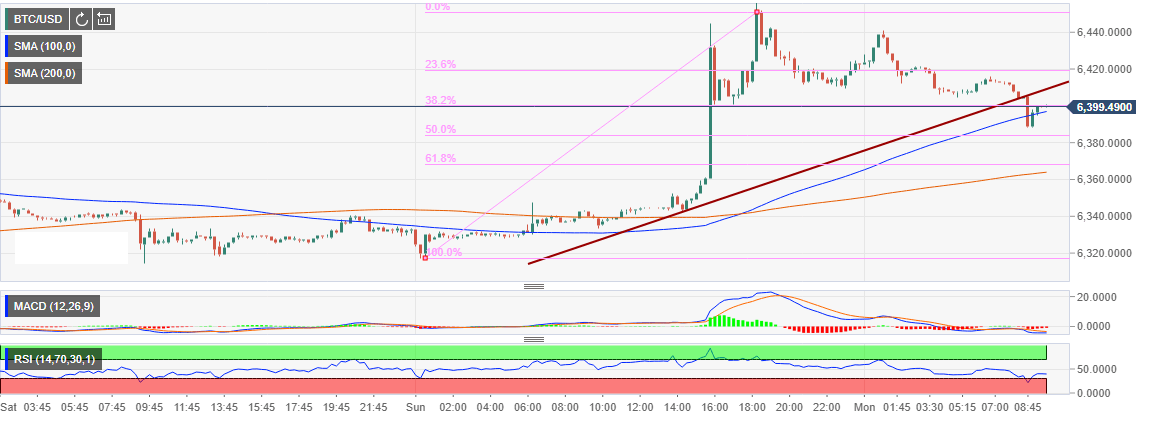

The price is currently hammering on $6,400 after a bullish move from the intraday lows. The 50 SMA is holding the price at6,397. A correction above $6,400 will encourage the bulls to reclaim the support above the trendline support. The RSI has retracted from the oversold but the MACD is still stuck in the negative region. This shows that Bitcoin price could remain stable around $6,400 in the near-term.

In other news, the latest blockchain ranking by the Chinese government has seen Bitcoin drop significantly from the 13th position to the 19th position. EOS continued to defend its 1st position while Ethereum (ETH) comes closely in the second position. The country starting ranking cryptocurrency projects in May this year and takes into account aspects such as the basic technology, their applicability and creativity.

BTC/USD 15′ chart