- As per Willy Woo, Bitcoin is currently in a bull market.

- BTC is currently consolidating in a symmetrical triangle pattern.

Have BitMEX traders camouflaged Bitcoin’s bull season?

Famous Bitcoin analyst, Willy Woo, tweeted that Bitcoin has been in a bull market since price recovered from last year’s $3k low. However, wild price swings by the BitMEX traders had camouflaged the bull market and made it extremely difficult to identify.

Woo was replying to a tweet by @IrishCryptoWolf, who had earlier stated that Bitcoin needed another round of investor capitulation before it makes a major move in the upward direction.

Earlier, Woo weighed in on the BitMEX-CFTC drama by saying that it was a necessary clean up before the industry paves the way for a Bitcoin ETF.

CFTC is wrecking BitMEX for wrecking Bitcoiners. It’s a necessary clean up step before an ETF can be approved. This is one of those “the herd is coming” events.

Speaking of which, BTC has recovered from the negative effects of the BitMEX-CFTC debacle as the price continues to consolidate in the symmetrical triangle pattern.

BTC/USD daily chart

The relative strength index (RSI) for the flagship cryptocurrency is trending around the midline as BTC’s supply and demand keep canceling each other out. If the price has a bearish breakout from the triangle, it will fall to the $10,600 support line, which should absorb most of the selling pressure (further explained in the IOMAp section).

However, the MACD shows sustained bullish momentum, so we can safely assume that the price will break upwards from the triangle pattern. Post break out, BTC should reach up to the $11,560 resistance line, as defined by the IOMAP.

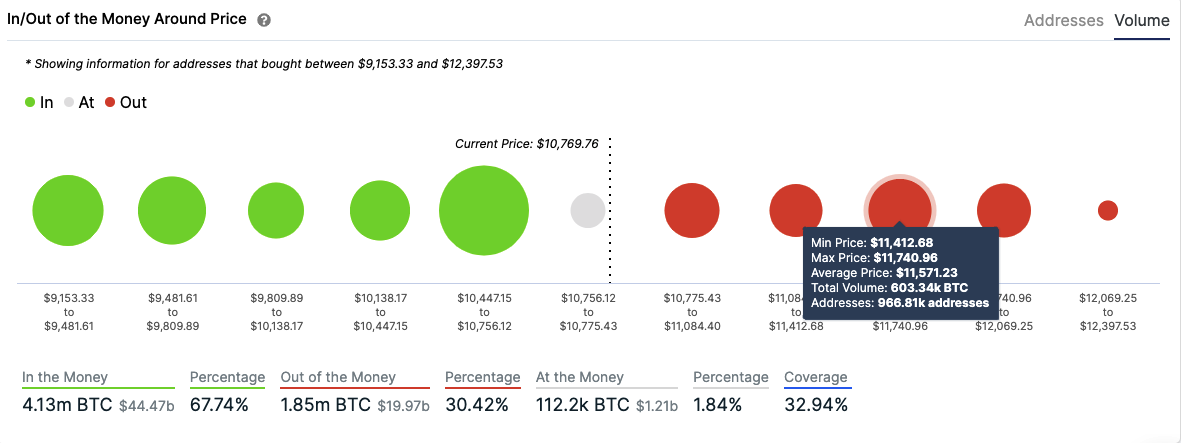

BTC IOMAP

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals a strong supply barrier at $10,600 that will prevent the largest cryptocurrency by market cap from falling to catastrophic levels. Previously, a little more than 2 million addresses had purchased 1.58M BTC.

On the upside, there are a few moderate and moderate-to-strong resistance levels. The most notable level is at $11,560, wherein 967k addresses had bought close to 605k BTC.

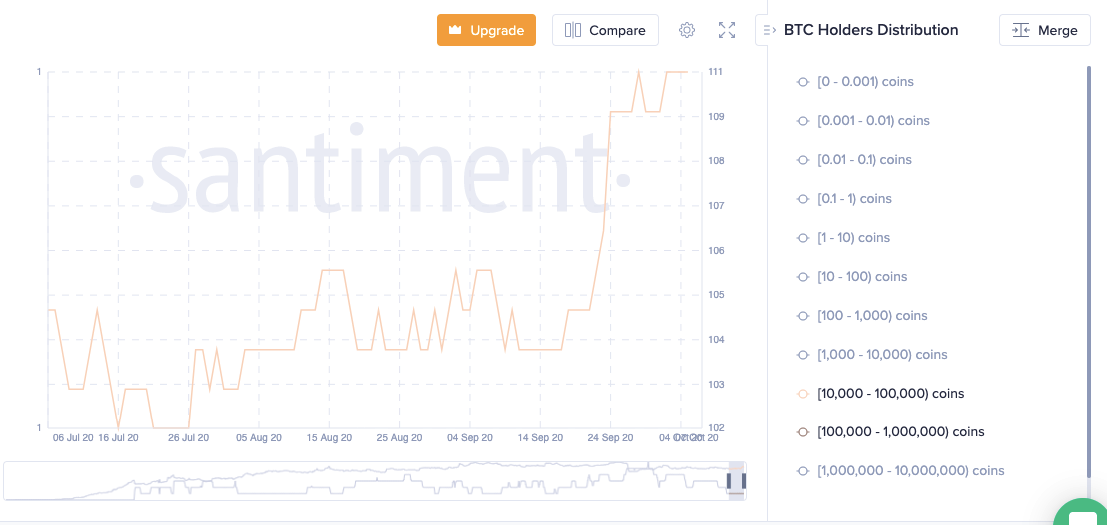

BTC holder distribution

Santiment’s holder distribution chart shows that since 16th July, the number of addresses with >10,000 BTC, aka “whales,” has increased significantly. As per the analytics firm, the number of addresses in the 10,000-100,000 BTC bracket has risen by 9 in this time period.

At first glance, the recent increase in the number of large investors behind BTC may seem insignificant. However, when considering that these whales hold millions of dollars worth of Bitcoin, this rise does feel pretty significant.