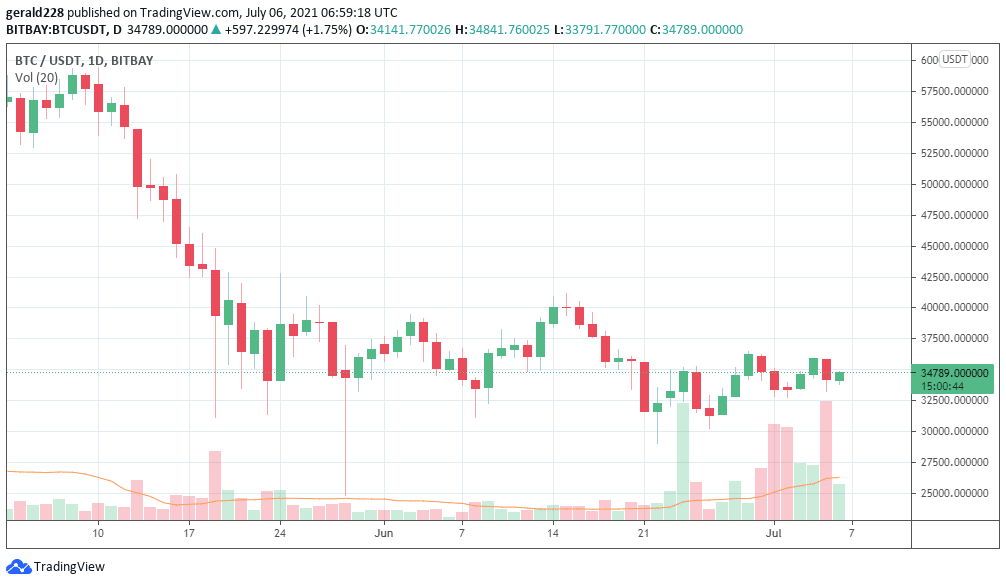

The Bitcoin price has had a slightly straddling start to the week. There was considerable optimism over the weekend with the price rising to the $36k mark. However, that price didn’t hold on Monday and a decline of around 8% saw the price drop to the $34,000 level with even that point being broken on some exchanges.

At present, Bitcoin is trading around the $34,700-$35,000 mark or a small 2% increase over the last 12 hours. Yesterday’s drop was particularly significant as Bitcoin found resistance at the $36,000 level and fell considerably from that mark to settle at the $34,000 level. However, Bitcoin is still up from its low of just under $30,000 on 26 June by around 15% so gains have been made over the past 7-10 days.

Short Term Bitcoin Price Forecast: A Retest of the $36K level?

After the rejection from the $36000 level, the Bitcoin price will have to close above the $35,200 level to signify a rebound. The next logical step would then be the $36,000 level. At present, the price is mired between the $34,000 and $34,700 levels with not much swing either way. Volatility is at a minimum although the resistance at the $36,000 mark seems quite strong.

If a bullish thesis were to come into play, the next logical step for Bitcoin to test would be the $36,800 level. If that is eventually broken then the next step would be breaking through the $37,000 mark for another assault on the $40,000 level.

Regulation and Crackdown on Crypto Affecting the BTC price

Although the markets are currently quite stable, continued talk of regulation in the crypto sphere is having an uncertain effect on the Bitcoin price. Whilst still almost 100% up from its December 2020 levels, it is considerably down from the high of $65000 achieved in early May.

Other FUD which affects investor sentiment is constant talk of a death cross when this has never yielded any particular price movement. The crackdown on crypto in China is also not a factor here whilst Binance seem to have sailed through their issues in the UK market with absolutely nothing happening on that front.

For a long-term prediction, Bitcoin seems to be moving forward to the $36,000 level although pressures remain. Turnover is down considerably from the highs seen in late April/early May although a recover could be on the cards if more positive sentiment hits the market.

Once the $40,000 mark is reached, the next step would be consolidating support at that level for a next jump to the $50k mark. However if $34k breaks again, this bullish thesis would be invalidated and the Bitcoin price could again test the psychologically significant 30K mark.