- Bitcoin liquidity supply is depleting from exchanges at a tremendous rate, significantly reducing selling pressure.

- The BTC leaving the exchanges is falling into the hands of long-term investors, a bullish signal.

Bitcoin is stuck in consolidation mode, but investor sentiment remains positive. As reported earlier, Grayscale Investments bought the recent dip adding over 8,000 BTC to its holdings.

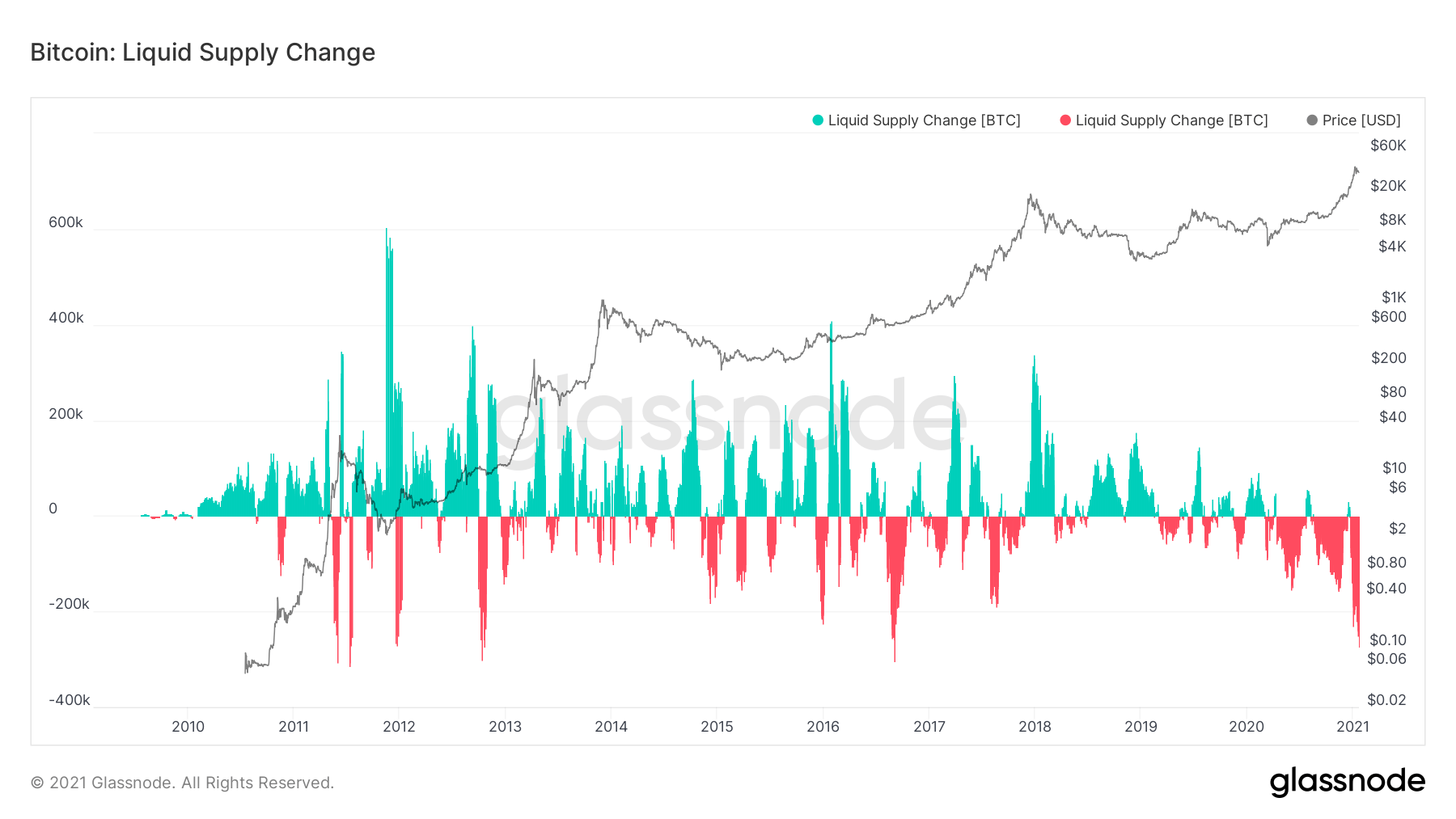

Additionally, the Liquid Supply Change, an on-chain metric by Glassnode, suggests that massive amounts of BTC are leaving the exchanges into wallets considered HODLers, which is an incredibly bullish signal.

Bitcoin supply depletion affirms the uptrend

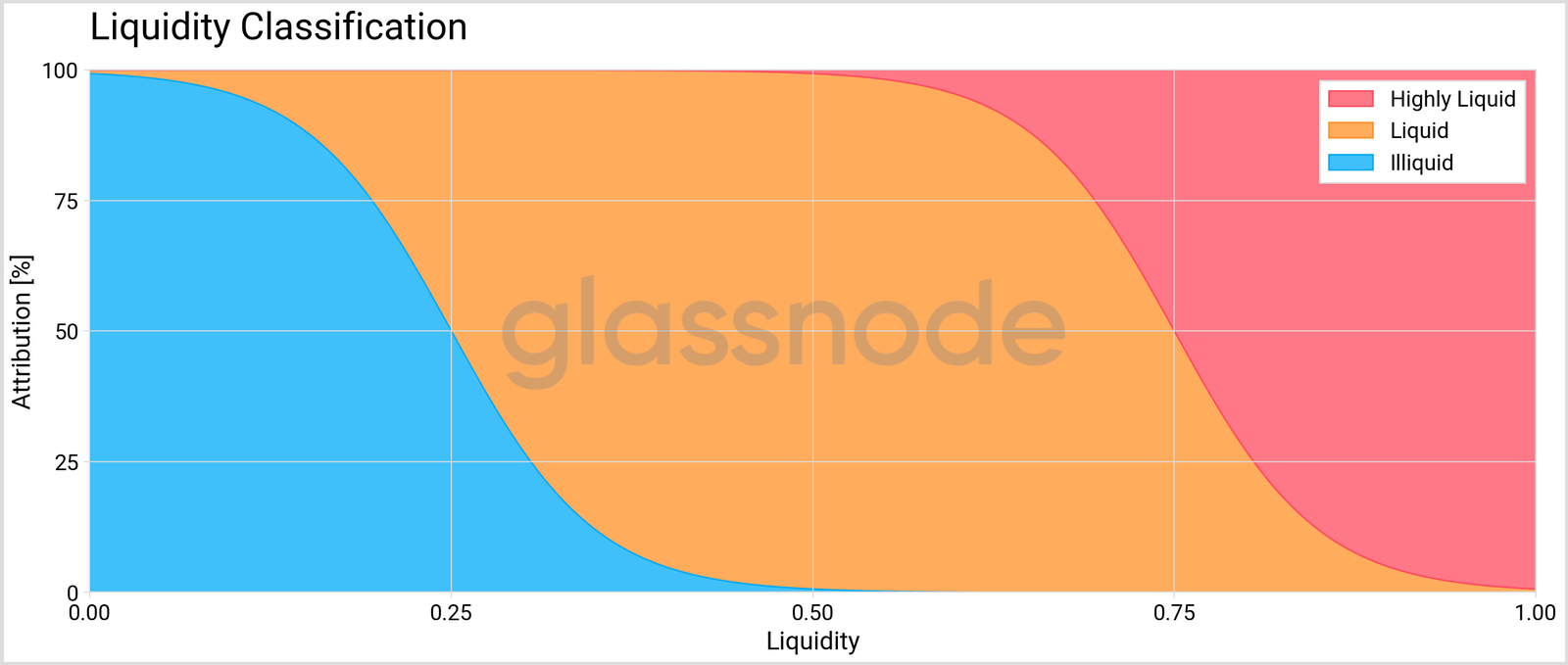

Bitcoin entities (individuals or institutions buying BTC) have been classified into two distinct categories by Glassnode, including highly-liquid, liquid and illiquid. The analysis platform has found out that a relationship exists between Bitcoin liquidity and the BTC market.

A quantified Bitcoin’s supply helps in understanding market behavior. For instance, if more BTC is illiquid, it suggests that the market is in a supply crisis. Therefore, selling pressure is extremely low, mainly because investor holding sentiment is high and the market is potentially bullish.

Long-term holders of Bitcoin mostly keep their cons in cold wallets. In other words, their BTC has been removed from the circulating supply and therefore it is unavailable for trading. Meanwhile, as Bitcoin rockets to new record highs, the supply has witnessed the biggest liquidity depletion in years.

Bitcoin Liquidity Supply change

The coins depart from the exchanges in large numbers but, again, ending up in the HODLers’ strong hands. Over the last 30 days, approximately 270,000 BTC has moved into the illiquid entities. As long as the liquid supply remains negative, this on-chain metric suggests that Bitcoin’s bull cycle will continue.

BTC/USD 4-hour chart

At the time of writing, Bitcoin is in consolidation slightly above $34,000. Support at this level must hold to avoid declines that are likely to extend to $32,000 (next support target). If overhead pressure soars, Bitcoin could revisit $30,000 (a former support area).

On the flip side, the uptrend to $40,000 will be validated if Bitcoin takes back the lost ground above $36,000. An increase of this magnitude will call for more buy orders due to the fear of missing out. Gains above $38,000 and $40,000 will occur as a result of intensifying the FOMO tailwind.

%20-%202021-01-21T112044.307-637468146205207308.png)