- Bitcoin must be supported by a catalyst in order to break above $4,000 and sustain growth past the stubborn $4,200 hurdle.

- The bulls must gather enough energy to clear the hurdle at $4,207.03.

It is now clear that demand-supply trends left on their own cannot support Bitcoin’s much-awaited uptrend. The 4-hour BTC/USD chart shows at least four failed attempts to sustain growth above $4,000 since Bitcoin traded 2019 lows around $3,340. The latest attempt mid-this week saw Bitcoin form a high around $4,057 but lack of strength to push for gains above $4,100 culminated in a sharp drop on Thursday. BTC/USD explored the levels towards $3,900 but found bearing at $3,920.67.

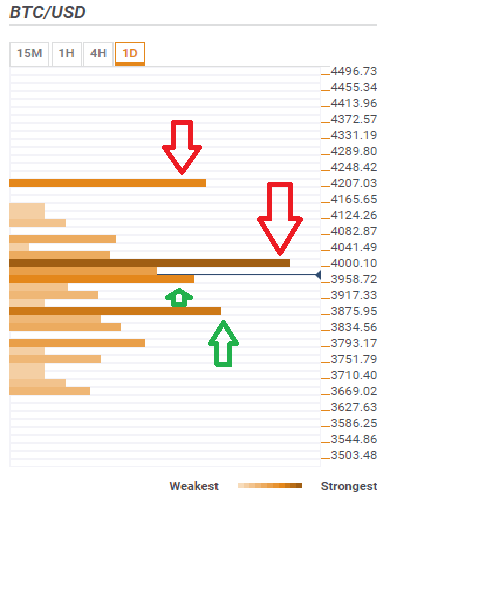

A reversal has since occurred from the weekly lows, although BTC/USD is still stuck below $4,000. Bitcoin must be supported by a catalyst in order to break above $4,000 and sustain growth past the stubborn $4,200 hurdle. The confluence detector tool shows the first resistance at $4,000.10. It is highlighted by the previous high 1-hour, previous high 15-minutes upper, Bollinger Band 15′ upper, 100 SMA 1-hour, 100 SMA 15′, the 23.6% Fib level 1-minute, 5 SMA daily, Bollinger Band 4-hour middle curve, 50 SMA 1-hour, 200 SMA 15, the 161.8% Fib level weekly and the 10 SMA 4-hour.

Above this level, Bitcoin is likely to sail smoothly past the week resistance zones at $4,041.49 and $4,082.87. The bulls must, however, gather enough energy to clear the hurdle at $4,207.03. An area marked by the previous month high, pivot point 1-day R3 and the pivot point monthly R1.

As far as the downside is concerned, the confluence detector places the initial support at $3,958.72. The confluence of indicators at this position include the 10 SMA daily, Bollinger Band 4-hour lower, Bollinger Band 1-hour lower, pivot point weekly R1, the 23.6% Fib level daily, 200 SMA 1-hour, and the 50 SMA 4-hour. The next support target is at $3,875.95 highlighted by the 38.2% Fib level 1′, the 61.8% Fib level weekly and the 200 SMA 4-hour. Below this zone, Bitcoin will not have any strong support zones and could plunge to lows around $3,500 and $3,000.