- Bitcoin is on the verge of a major correction as critical support gives way.

- A recovery below $22,800 is needed to mitigate the bearish pressure.

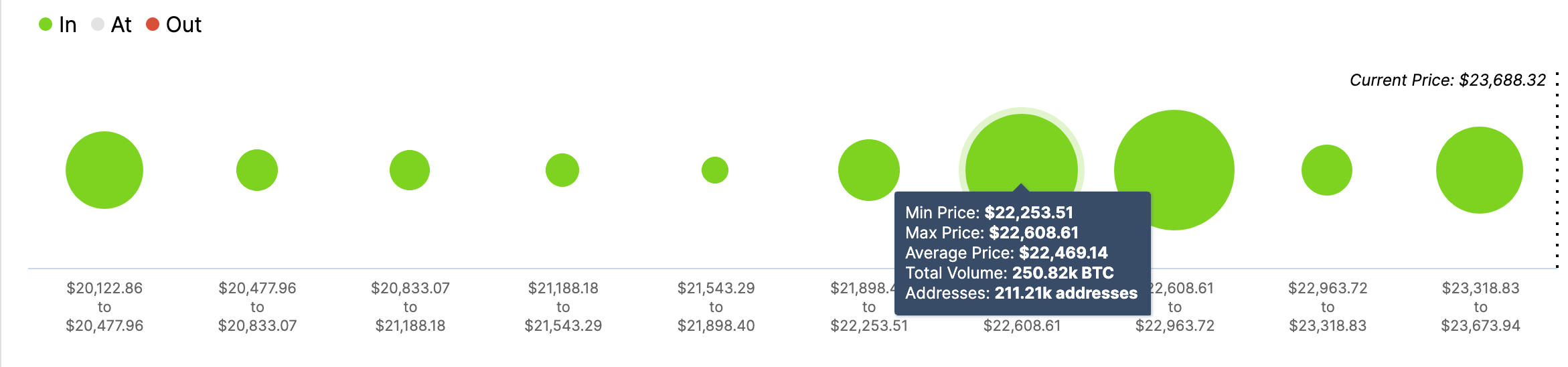

Bitcoin is testing waters below $22,3000, which may lead to catastrophic consequences for the pioneer digital coin. IntoTheBlock’s IOMAP shows that there is a big cluster of addresses that purchased BTC around that price. If it gives way on a sustainable basis, the sell-off will be extended to another support created by a psychological $20,000 with nearly 200,000 having purchased over 90,000 BTC around that area.

BTC, In/Out of the Money Around Price

Apart from that, a behavioral analytics data provider, Santiment, shows that addresses holding 1,000 to 10,000 BTC have been selling off recently, adding credibility to the short-term bearish outlook.

BTC, Holders’ Distribution

While the number of whales leaving the network might seem insignificant, it should be mentioned that each of them holds from $22 million to $220 million worth BTC, meaning that even a small shift may result in an immense selling pressure that will affect the spot price.

A sustainable move below $22,800 also increased the selling pressure. As FXStreet previously reported, this barrier was critical for Bitcoin’s trend in the short run. A failure to return above this level may lead to a deep sell-off towards $20,000. If this area gives way, BTC may see a sell-off towards $16,000 before another bullish wave starts.

%20%5B04.29.56,%2021%20Dec,%202020%5D%20(1)-637441531319456187.png)