Bitcoin price went into the weekend displaying weakness, which meant our prediction that bulls would target $35k may not have seemed likely, but that is eventually how the weekend played out, with BTC currently priced at $34,850.

The top virtual currency is doing its best to confirm the $30k floor is solid, despite its penetration at the beginning of last week, and that is cheering bulls and pulling the rest of the crypto market along for the ride.

UK ‘Binance ban’ is not a ban

However, the Financial Times story that Binance, arguably the world’s largest crypto exchange, was being banned in the UK did not go down well – the price fell immediately in response.

But a closer inspection of the Financial Conduct Authority consumer warning shows that the story is nowhere near as dramatic as the headlines would have you believe.

In reality it is the regulated activities that Binance must cease offering and/or make clear through a statement on its website and social media outlets that is does not authorised to offer trading in regulated areas. The statement has to be in place by Wednesday and must read as follows: “BINANCE MARKETS LIMITED IS NOT PERMITTED TO UNDERTAKE ANY REGULATED ACTIVITY IN THE UK.”

In the UK the only areas of crypto that are regulated are derivatives. The ban refers to the Binance Markets Ltd entity, which is a rebranded UK company the group had previously acquired that does have regulatory permissions in currencies, but Binance has nor exercised those permissions.

So basically the FCA consumer warning has no effect on UK crypto traders wanting to use Binance to buy and sell crypto on spot markets and has no bearing on the funds held on the exchange.

Binance belatedly made this interpretation abundantly clear on its Twitter account yesterday but the media is still talking about Binance being banned, which is not the case.

Binance created Binance Markets Ltd with the intention of repeating the approach taken in the US, where it set up a separate company called Binance US which seeks to “proactively” comply with all regulatory requirements.

Binance Markets Ltd is not currently providing any consumer-facing services, in either cryptocurrencies or derivatives based on them.

Binance keeps running into trouble with regulators around the world, with Japan banning the exchange from operating in the country and Germany seeking clarification on its fractionalised shares market, although they are still available. The fast-growing exchange is also attracting unwelcome attention because of its opaque corporate structure as it famously has no single headquarters.

Bitcoin price strong defence of $30k cheers bulls

Bitcoin market participants are seeing through this bout of news-driven negativity, if the current price strength is anything to go by.

It is never a good idea to keep funds on an exchange but many still do because of the convenience. The best form of storage is in a hardware wallet that is not connected to the internet.

More worrisome for bulls, perhaps is the continued seeping away of trading volume and i particular what that might say about institutional interest in the nascent asset class.

Crypto fund provider CoinShares weekly data continues to show net outflows from the sector and exchange data is also showing net withdrawals. Coinshares’ own exchange traded products have witnessed their seventh consecutive week of outflows.

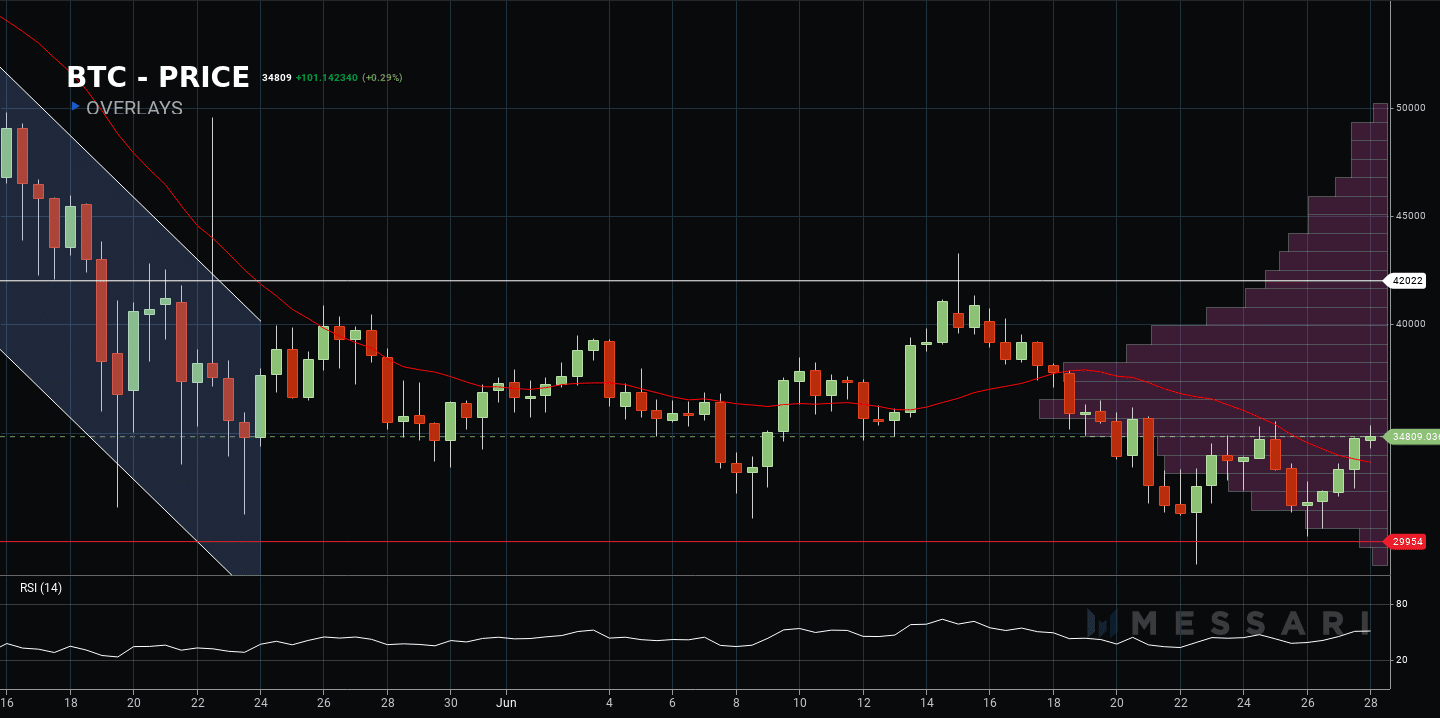

Nevertheless, the solid defence of $30,000 is encouraging and bitcoin is leading the market higher at the beginning of the European session, which could feed into further buying as the all-important US market gets going. Bitcoin is trading comfortably above its 20-day moving average on the 12-hour chart (see red line in chart above).

The price is now at a crossroads. Another try for the $40k region and stiff resistance at $42,000 looks like a possibility this week, but equally there could be yet another test of the $30k – and there is only so many times that can be done before it breaks in a decisive fashion, in which case the low $20ks could come into view, as JPMorgan strategists predicted last week.

Looking to buy or trade Bitcoin now? Invest at eToro!

Capital at risk