- BTC/USD is rangebound with a bearish bias.

- Substantial support is created by $7,750 handle.

The first digital coin is hovering at $7,900 handle amid growing market indecision. BTC/USD has lost about 1% of its value since the beginning of Tuesday and become 1.3% cheaper from this time on Monday. While the coin has recovered from Monday’s low of $7,576, the upside momentum is not strong enough to take it above critical $8,000.

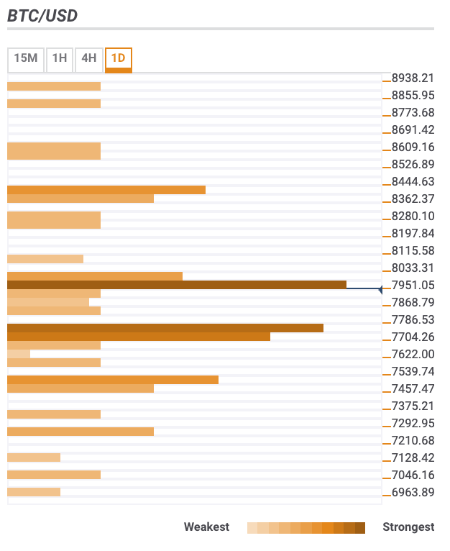

Bitcoin confluence levels

There are a lot of substantial technical barriers clustered above and below the current price. It means that Bitcoin might be vulnerable to rangebound trading.

Resistance levels

$7,9500 – SMA5, SMA50 and SMA20 15-min, SMA50 1-hour, 23.6% Fibo retracement weekly;

$8,000 – SMA10 on 1-hour and 4-hour intervals, 61.8% Fibo retracement daily, the upper boundary of 15-min Bollinger Band

$8,380 – upper boundary of 4-hour Bollinger Band, the highest level of the previous week.

Support levels

$7,750 – SMA50 4-hour and SMA200 1-hour, the middle line of 4-hour Bollinger Band, 23.6% Fibo retracement daily.

$7,500 – Pivot Point 1-month Resistance 3.

$7,250 – 61.8% Fibo retracement weekly

BTC/USD, 1-day