- Bitcoin price embraces consolidation between $9,200 support and the key resistance zone at $9,400.

- BTC/USD is still in grave danger of falling back to $9,000 especially if the short term trendline caves in.

Bitcoin lethargic trading has been very dominant since the week started. Following recovery from the drop to $8,726 in the last week of June, BTC/USD has not been able to trade above $9,400. Besides, sustaining the price above $9,300 has been an uphill task. For instance, at the time of writing, Bitcoin is in retreat towards $9,250. If the declines continue under the short term ascending trendline, we can expect Bitcoin to spiral below $9,200 and even retest $9,000.

For now, the biggest mission for the bulls is to reclaim the position above $9,300 and sustain the gains towards $9,400. Unfortunately, bears seem to be carrying the day especially with the RSI falling towards the midline. The MACD hit a snag at 68 after recovery from -25. However, the indicator has slowed down the downtrend, holding above the mean line (0.00). Consolidation is likely to continue as long as the MACD holds in the positive zone.

BTC/USD 2-hour chart

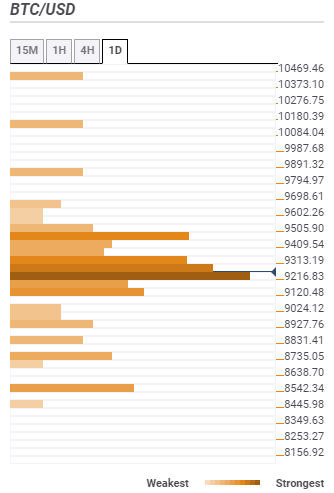

Bitcoin confluence resistance and support areas

Looking at the confluence detector tool, Bitcoin is holding above a strong support area. This means that buyers can comfortably focus on pushing the price higher. The following are some of the key resistance and support areas:

Resistance one: $9,313 – Is home to the previous high 15-minutes, the Fibo 38.2% one-day, the Bollinger Band 15-minutes middle, the SMA five 1-hour, SMA ten 15-minutes and the previous week high.

Resistance two: $9,505 – Highlighted by the pivot one-week resistance two, the Fibo 161.8% one-day and the pivot point one-day resistance two.

Support one: $9,216 – This the strongest support zone and home to the SMA 100 4-hour, the Bollinger Band 1-hour lower curve, Bollinger Band 15-mins lower, the previous low 4-hour, the Fibo 23.6% one-day, the SMA 200 15-mins and the pivot point one-week resistance one.

Support two: $9,120 – Highlighted by the Fibonacci 61.8% one-week and the pivot point one-day support two.

-637297824903995874.png)