- Bitcoin price holds above $7,200 support but a trader, Henrik Zeberg, predicts fall to $1,000.

- BTC/USD could smoothly sail towards $8,000 if the seller congestion at $7,436 is cleared.

Bitcoin price is struggling to hold above $7,300 after being rejected from levels above $7,400. Bearish correction is witnessed across the market led by the top three coins; Bitcoin, Ethereum and Ripple. BTC/USD is teetering at $7,318 following an adjustment from $7,369 (opening value). The prevailing trend is bearish while the volatility low. This means, in the short term, Bitcoin is unlikely to fall by a large margin.

According to a cryptocurrency trader and a macroeconomist, Henrik Zeberg, Bitcoin is delicately balancing above $7,200 support. Zeberg believes that most people are failing to understand both Bitcoin and gold. In his opinion, both assets are grinding closer and closer to another wild selloff. He predicts Bitcoin fall to $1,000 after revising the target from $2,000.

#Bitcoin and #Gold are so misunderstood at this point! We have strong illiquid phase in front of us. SP500 from ~2600 to ~1800. That is another ~30% drop! Everything will be sold off! I have take my target for Bitcoin down to ~1000 USD before bottom pic.twitter.com/Q0ugvqddlZ

— Henrik Zeberg (@HenrikZeberg) April 7, 2020

Bitcoin price confluence levels

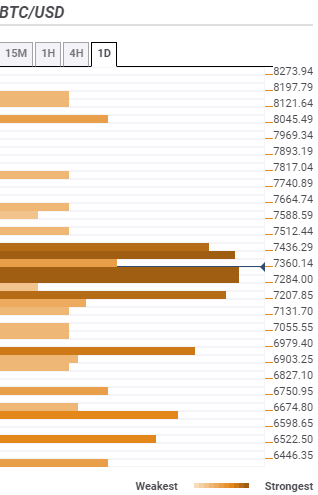

Data from the confluence tool suggests that Bitcoin will have a hard time continuing with the trend above $7,400 especially with the strongest resistance at $7,436. In this zone, the SMA 50 one-day, the previous high one-day and the Bollinger Band one-day upper curve highlight the resistance. However, a breakout above this zone could see BTC/USD smoothly sail above $8,000 apart from some shallow bumps at $7,817 and $8,045.

In the event upward movement is cut short and losses take over, the first support is observed at $7,284 as shown by the BB 1-hour lower curve, the previous week high, the Fibo 61.8% one-day and the previous low 4-hour. The next support target holds ground at $7,207 and highlighted by the 61.8% one-month and the pivot point one-day support one. Extended downward movement could seek refuge at 6,979, $6,674 and $6,522.