- BTC/USD is back at $3,800 after a short recovery.

- $3,900 remains unbroken.

BTC/USD attempted to make its way towards $3,900. However, the price stopped short of the said level amid strong speculative interest located on approach. BTC/USD is changing hands at $3,810, practically unchanged on a day-on-day basis and down 3% in recent seven days.

The fundamental development has been somewhat positive in the crypto space lately. Thus, Julius Baer, the largest private bank in Switzerland, jumped the crypto bandwagon, by offering crypto services to its customers. The company entered a partnership deal with SEBA Crypto AG. Also, Singapore-based wealth fund GIC is said to participate in Coinbase financing round, singling a wider cryptocurrency adoption among large institutional investors.

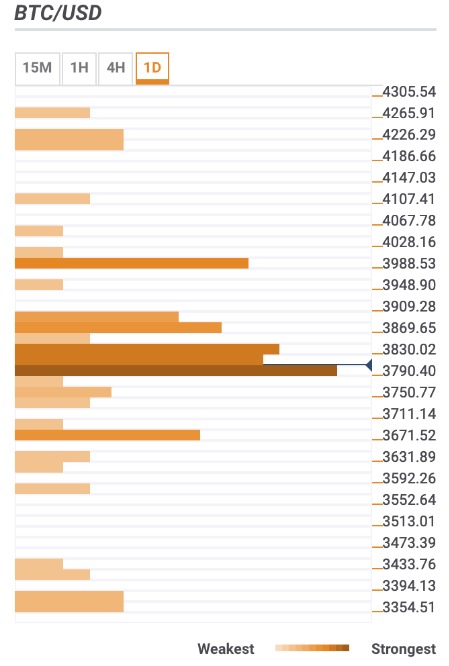

BTC/USD the daily confluence detector

There is a cluster of critical technical levels right below the current price that goes all the way down to $3,700. The confluence of barriers include:

- DMA100, SMA100 4hour

- Fibonacci retracement level (23.6% daily)

- Lower boundaries of Bollinger Bands on 1-hour and 4-hour charts

Once we manage to pass this area more critical support around $3,600 will come into focus. It is strengthened by DMA100 which makes it a hard nut to crack for the bears.

The next barrier comes on approach to $3,400 with the lower line of daily Bollinger Band. It is followed closely by SMA200 weekly at $3,380.

On the upside, we still have a pack of technical barriers all the way up to $3,900, including a host of SMA levels, middle line of Bollinger Band 1-hour and 4-hour, Fibonacci retracement 38.2% (daily, monthly and weekly), and Fibo retracement 23.6% weekly.

The next resistance lies with psychological $4,000 with Fibo 23.6% monthly on approach, and $4,200 supported by Pivot Point 1-month Resistance 1 and February high.

BTC/USD, 1D