- The cryptocurrency market lived through a disastrous week.

- Fundamental developments confirm that digital assets are penetrating the mainstream system.

- The short-term price recovery is limited by $12,000.

The cryptocurrency market is desperately red this week with Bitcoin and the majority of altcoins nursing losses on a week-on-week basis. A head-spinning growth to new multi-month highs ended in a spectacular crash, as the market chased weak longs and retreated from overbought territory. From the longer-term perspective, we are still in a well-established bull’s trend, while a current sell-off qualifies as a natural correction.

What’s going on in the market

The first week of July was marked by lots of fundamental developments. While the market players are still fixated on everything related to Facebook’s Libra, there have some other events that may signal that digital currencies are becoming mainstream, slowly but steadily.Thus, the British regulator approved the first crypto hedge fund in the UK. Prime Factor Capital received a license as a full-scope alternative investment. Though the fund will have to abide by the strict European limitations, this is a positive development for the industry.

Meanwhile, Cuba is considering digital assets as a part of anti-crisis measures. The government wants to use it to escape US sanctions and fight inflation. Hopefully, it will do a better job than Venezuela that messed it up with Petro and failed to use the digital asset to its advantage. If Cuba enjoys success with its digital currency (if there is any), other sanction-stricken countries may follow suit. Thus, the idea might be relevant for Russia as the Russian Association of Cryptocurrency and Blockchain (RACIB) mentioned on Twitter.

Meanwhile, the deputy minister of finance in Russia Alexey Moiseev said that Russia would never legalize cryptocurrency for settlements. The digital assets might be treated more like a foreign currency where the citizens can buy, sell and hold it, but they are not allowed to pay with it for goods and services. It is worth mentioning the country is still waiting for the law on digital assets to be approved by the State Duma. The legislation may be finalized by the end of July, though the fundamental aspects of the bill are still a matter for debate.

Facebook’s Libra remains a favorite punching bag for both authorities and industry leaders. Governments continue questioning the legitimacy of the coin that is not even issued, while cryptocurrency experts consider it as a kid of their class enemy. Joseph E. Stiglitz, a Nobel laureate in economics, said that no one would ever trust Facebook’s digital currency as it may be used by criminals to cover up their illegal activities.

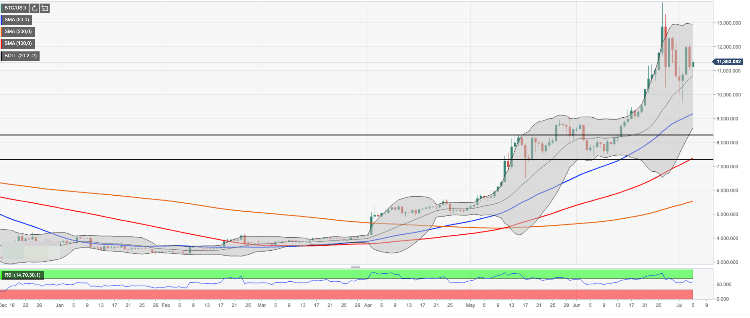

BTC/USD, 1D chart

Bitcoin has lived through a volatile week as the price of the first cryptocurrency collapsed from the multi-month high of $13,796 reached on June 26 and touched $9,657 on July 2. While the price has recovered to $11,400 by the time of writing, bears are behind the driving wheel. The coin has lost 5% in recent seven days, while its market share reached 62.4%.

Looking technically, we will need to see a sustainable move above $12,000 handle for the recovery to gain traction. As long as the price stays below the said barrier, we are in for range-bound trading, potentially, with a bearish bias. This area has been rejected twice during this week; thus, once it is cleared, the upside is likely to gain traction with the next focus on $13,000. This barrier is strengthened by the upper boundary of the 1-day Bollinger Band located on approach and followed by the recent high of $13,700.

Considering that the Relative Strength Index (RSI) on a daily chart is flat and stays outside an overbought territory, we may be in some period of consolidation in a wide range before the directional move is resumed.

On the downside, a sustainable move below $11,000 will increase the downside pressure and take the price towards the next support of $10,300 (the lower boundary of 4-hour Bollinger Band). This area is followed by psychological $10,000 protected by stop orders and followed by $9,640 (the lowest level of the week and SMA200 on 4-hour chart). New buying interest is likely to appear on approach to this handle and create a new recovery wave.

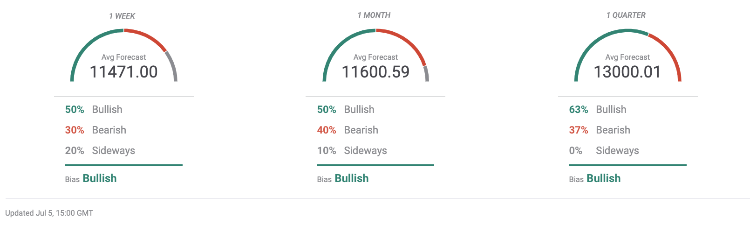

The Forecast Poll of experts shows a mixed picture. While both short-term and long-term expectations are mostly bullish, the forecasters do not expect the price to move above $12,000 in the nearest future. Both weekly and monthly forecasts imply that the price will stay below this handle and move towards $13,000 only by the end of the quarter.