- Bitcoin price had a mixed week but was largely bearish as it tanked to seek support at the $48,000 level.

- BTC price forecast for the week ahead is bearish as accentuated by the MACD and RSI.

- Increased institutional adoption is expected to increased Bitcoin investors’ appetite in the long-term.

It has been a mixed week for the Bitcoin price as it displayed a choppy price action with no clear confirmed directional bias. BTC slid below the crucial July trendline as selling pressure pushed the flagship crypto lower to areas around $46,300 during the week. As such, Bitcoin has lost just 1.5% in 7 days characterising BTC’s market indecision.

So, what was the week like for Bitcoin?

Bitcoin Price, The Week That Was

BTC/USD price rose by approximately 5% in the week ending August 22. Slightly falling short of the 7% from the previous week, Bitcoin closed Sunday August 22 at $49,321.65.

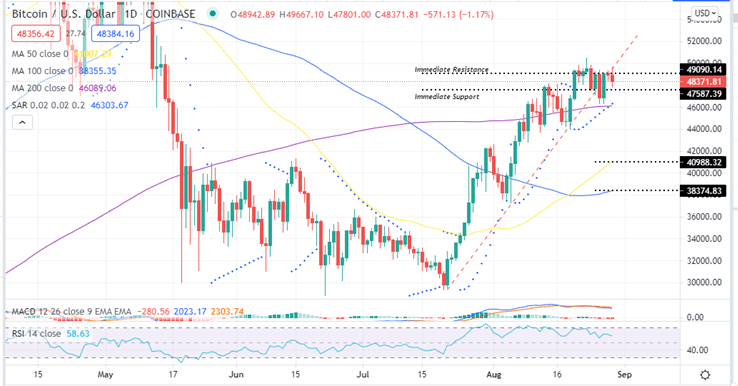

Bitcoin price started the week trading in green as bulls tried to overcome the $50,000 barrier in a continued sideways market movement. The asset recorded an intraweek high of $50,482 on Monday. Rejection from the $50,000 psychological level saw BTC tank below the $48,000 psychological level, as things turned bearish on Tuesday.

BTC has been trading in alternating bearish and bullish sessions between Monday and Saturday while recording lower highs and lower lows finding support at the $46,000 support wall embraced by the 200-day SMA. This bolstered bulls who strived to push the Bitcoin price from an intraweek low of $46,394 on Friday to close the day around $49,058.

Saturday’s bearish session saw the Bitcoin price rejected by the stubborn resistance at the $49,090 level to close the day at $48,902. At the time of writing, BTC teeters at $48,371.

- Are you new to Bitcoin trading? Read our guide on the best Bitcoin exchange to get started.

During the week, BTC price failed to hold above the $50,000 mark and lost 1.5% to slide below the $49,000 psychological level. This including 15% drop between Monday high and Friday low were the week’s downside.

Bitcoin Price (BTC/USD) Daily Chart

BTC Price, The Week Ahead

Bitcoin price prediction for the week ahead remains bearish as it has been struggling to maintain its bullish momentum.

Note if BTC closes the day on Sunday above immediate resistance at $49,090, the bellwether cryptocurrency could jump above the $50,000 psychological level after which a push to all-time high above $64,000 would be the next logical move. This would represent almost a 34% gain from the current price.

Note that closing the week below the immediate support at $47,800, BTC price would slip below the $46,000 mark currently embraced by the 200-day Simple Moving Average (SMA) and revisit the 50-and 100-day SMAs at $40,988 and $38,374 respectively.

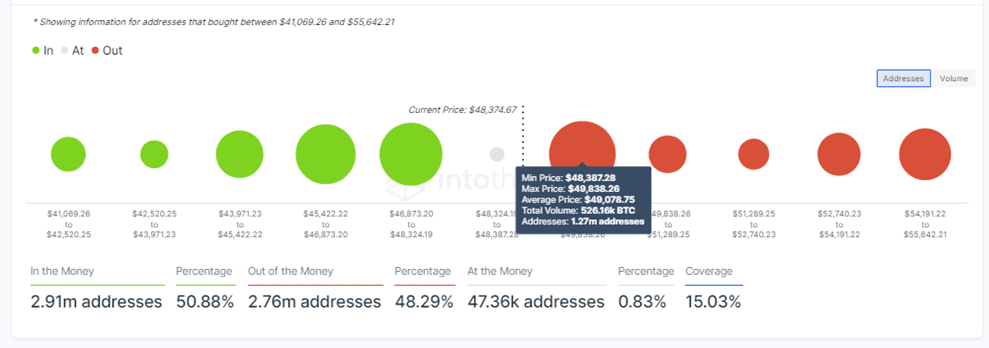

In/Out of the Money Around Price (IOMAP) on-chain metrics by IntoTheBlock’s reveals that BTC faces immense resistance upwards. The immediate resistance around the $47,800 zone is within the $48,387 and $49,838 investor cluster where around 526,160 million BTC were previously bought by about 1.27 million addresses. These investors might want to break even curtailing any efforts to push Bitcoin higher.

Bitcoin IOMAP Chart

Apart from the IOMAP, technical indicators such as the parabolic SAR, the Moving Average Convergence Divergence (MACD) indicators validate Bitcoin’s bearish bias. The parabolic SAR changed from positive to negative on August 20 and as long as it remain below the price, Bitcoin’s bearish leg is set to continue. The MACD’s continued movement below the signal line and the downward movement of the RSI away from the overbought zone adds credence to this bearish narrative.

Can Bitcoin’s Bearish Narrative Be reversed?

A part from the upsloping moving averages and the position of the MACD above the zero line on the daily chart shows that Bitcoin’s long-term price prediction appears bullish.

In addition, positive fundamentals such as increased institutional adoption may increase Bitcoin price buying appetite. For example, on August 23, PayPal announced that it was providing cryptocurrency services to its UK customers. This service will allow verified PayPal customers in UK to buy, sell and hold Bitcoin, Ethereum, Litecoin and Bitcoin cash. PayPal hopes to roll-out this service to all of its over $400 million users globally.

Additionally, MicroStrategy, has purchased more Bitcoin adding 3,907 BTC to its BTC holdings. According to data from a Form 8-K filing with the United States SEC published on August 24, the business intelligence firm increased its Bitcoin holdings by 3,907 BTC between July 1 and Monday, August 23. The form also revealed that MicroStrategy used to the upside of $45,294 to purchase more Bitcoin.

Furthermore, Citigroup is seeking to trade Chicago Mercantile Exchange (CME) Bitcoin futures once it receives regulatory approval. According to an inside source who spoke to CoinDesk, Citi is waiting to receive regulatory approval to start trading Bitcoin futures on the CME.

Latest on the adoption is Holly Kim, a Lake County treasurer in Illinois, who is reportedly accepting donations in cryptocurrency to support her re-election campaign. She becomes the first political candidate in the state to do so. Kim is reportedly accepting Bitcoin (BTC), Dogecoin (DOGE), Ethereum (ETH) and Dai (DAI) donations.

Where To Buy BTC?

If you wish to buy cryptocurrencies including Bitcoin, exchanges such as eToro , Binance, Coinbase, Bittrex and Kraken are good places to visit.

Looking to buy or trade Bitcoin now? Invest at eToro!

Capital at risk