- Bitcoin price slide below the 200-day SMA to drop 8% between September 05 and September 12.

- Overcoming the 200-day SMA at $46,000 will bolster the BTC to revisit the May 10 range high around $59,540.

- Bitcoin upwards movement to be bolstered by such developments as the Ukraine Parliament passing a bill legalising cryptocurrencies.

Bitcoin price is trading in the green at $45,962.1, up 0.73% in the last 24 hours as bulls try to undo the losses started on September 07. During the Tuesday crypto market flash crash, BTC fell approximately 10% to close the day around $46,920. The flash crash saw Bitcoin lose as much as 19% to lows of around $42,712.

The bearish leg continued on Wednesday. BTC tried to recover on Thursday but the bears came back to the scene on Friday with a focus on the $45,000 mark.

- Are you new to crypto trading? This guide on the best cryptocurrency to buy is a good place to begin

So, what was the week like for Bitcoin?

Bitcoin Price, The Week That Was

BTC/USD price rose by approximately 10% in the week ending September 05. Significantly better that the 4.3% drop witnessed the previous week. Bitcoin closed Sunday September 05 at $51,745.

Bitcoin price started the week on trading in green as the bulls pushed the flagship cryptocurrency above the $52,000 psychological level on Monday. Robust from around the $51,700 area saw BTC close the day around $52,859 on Monday.

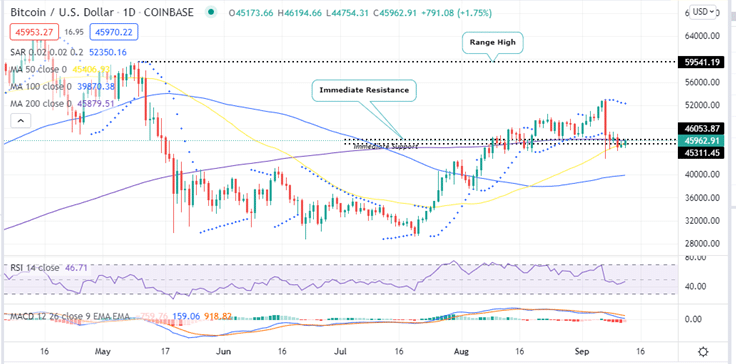

Tuesday’s crypto market flash crash saw Bitcoin price drop below the 200-day Simple Moving Average (SMA) at $46,000 and the 50-day SMA at $44,000 to record a low of $42,712,. Dropping below these two key technical levels meant that the sellers were significantly controlling BTC. However, he long lower wick on Tuesday’s candle shows that the bulls were not ready to let go of the support provided by this technical level as BTC recorded an intraweek high of $53,230.

BTC has been trading in alternating bearish and bullish sessions between Wednesday and Saturday while recording lower lows flipping the 200-day SMA at $46,000 from support to resistance on Friday.

On Saturday , the BTC bulls strived to push the Bitcoin price past the 200-day SMA but their efforts were in vain as Bitcoin closed the day at $45,187. At the time of writing, Bitcoin is trading at $45,962.

During this week BTC dropped 8.41%, lost the $50,000 crucial support and flipped the 200-SMA at $46,000 from support to resistance. This has been the week’s downside.

BTC/USD Daily Chart

BTC Price, The Week Ahead

Bitcoin price prediction for the week ahead is bullish as it targets the May 10 range-high above $59,540.

Note if Bitcoin closes the day above immediate resistance at $46,000 (200-day SMA), the asset could jump above $4,800 psychological level after which a push to the May 10 range high around $59,540 would be the next logical move. This would represent almost a 29% rise from the current price.

This bullish outlook is accentuated by a number of technical indictors. For example, the Movign Average Convergence Divergence (MACD) indicator is movign above the zero line in the positive region. This is asn indication that Bitcoin market momentum is bullish in the long-term. Moreover, the upward movement of the Relative Strength Index (RSI) indicator shows that the bulls are currently in control of the BTC price and are determined to push it higher.

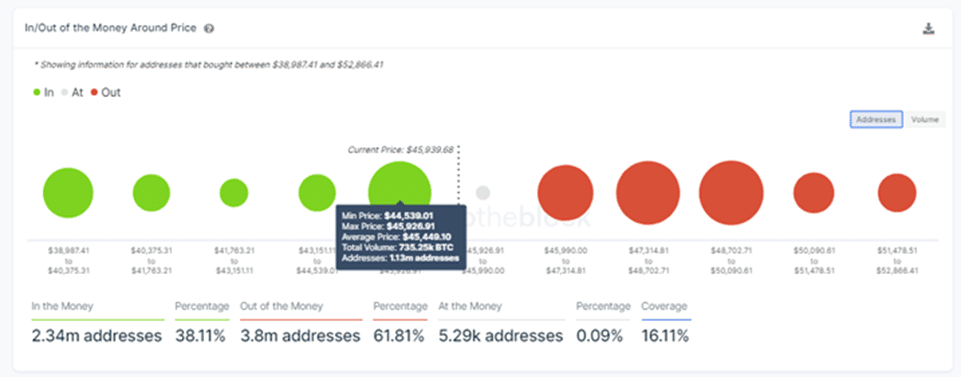

A look at the daily chart also shows that BTC is sitting on strong support provided particularly by the 50-day SMA at $45,311, and the 100-day SMA at $40,000. This outlook is supported by on-chain metrics from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) Model which shows that Bitcoin is sittig on strong support immediate support

According to the IOMAP chart, the immediate support provided by the 50-day SMA around $45,311 is within the $44,539 and $45,926 price range where approximately 735,250 BTC were previusly bought by roughly 1.13 million addresses. This support is robust enough to counter any selling pressure aimed at pulling Bitcoin further down.

Bitcoin IOMAP Chart

On the flipside, if Bitcoin manages to overcome the 200-day SMA, its path upwards is not as easy as it is laden with stiff resistance as shown by the IOMAP chart.

Note that closing the day below the immediate support at $45,311 BTC price would drop to seek support at the $44,000 psychological level. A weekly closure below the $44,000 mark will push Bitcoin lower towards the $42,700 support wall or the $40,000 mark embraced by the 100-day SMA.

Positive Fundamentals to Boost Bitcoin Price Investor Appetite

A part from the upsloping moving averages and the position of the MACD above the zero line on the daily chart shows that Bitcoin’s long-term price prediction appears bullish.

In addition, positive fundamentals such as increased institutional adoption may increase Bitcoin price buying appetite. For example, Ukrainian parliament has passed a bill legalising and regulating Bitcoin and other cryptocurrencies in the country. This is an important step for the European country as it provides official clarity on the digital assets and which was in a grey area previously.

On Wednesday September 08, the Ukrainian Parliament passed Bill No. 3637 On Virtual Assets that gives the Ukrainian government the ability to legally regulate digital assets. The Bill states that:

“This Law regulates legal relations arising in connection with the turnover of virtual assets in Ukraine, defines the rights and obligations of participants in the virtual assets market, the principles of state policy in the field of virtual assets.”

The bill which was set in motion in 2020 passed with an almost unanimous vote with 276 legislators supporting it and only six voting against it. The bill now heads to the desk of President Volodymyr Zelensky who will not sign it into law.

Previously, Ukrainians were allowed to buy and exchange virtual currencies, but companies and exchanges dealing in crypto were often under close watch by law enforcement because of lack of clear law regarding cryptocurrencies.

However, the law does not make cryptocurrencies legal tender as with Bitcoin in El Salvador. This means that cryptos still cannot be used to pay for goods and services in Ukraine.

This is still a win for the world of cryptocurrencies as the law allows for blockchain companies to legalize individual business processes and work directly with the current banking system.

It also allows citizens to freely buy and trade Litecoin and other digital assets.

The hryvnia remains the only legal currency in the country.

Where To Buy BTC?

If you wish to buy cryptocurrencies including Bitcoin, exchanges such as eToro , Binance, Coinbase, Bittrex and Kraken are good places to visit.

Looking to buy or trade Bitcoin now? Invest at eToro!

Capital at risk