- In April Bitcoin posted double-digit gains making April the most successful month this year.

- BTC/USD is changing hands at $5,571; the technicals remain strongly positive.

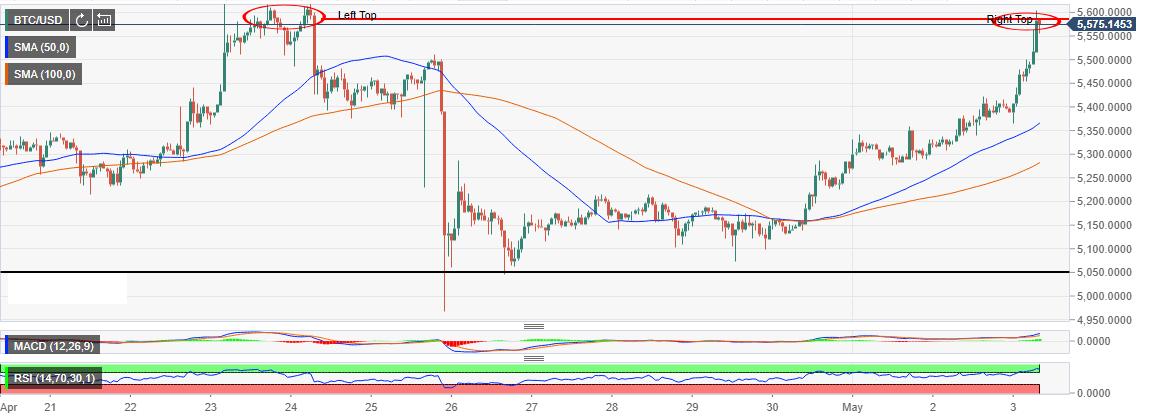

Bitcoin is once again proving to the industry that it has entered a bullish phase and could have actually found a bottom following the year-long declines since 2018. Besides, in April Bitcoin posted double-digit gains making April the most successful month this year in terms of gains. This not to say that April was an all bullish month, Bitcoin had its share of devastating dips, for instance, the one in the last week of the month that sent Bitcoin tumbling from 2019 highs only to find support around $4,950.

However, Bitcoin has since recovered from the lows traded last week. Moreover, it stepped above both the 50 Simple Moving Average (SMA) 1-hour and the 100 SMA. More upside movements cemented the bullish entering into May. BTC Buyers’ confidence shot up significantly on reclaiming the support congestion zone between $5,300 and $5,400.

The trading on Friday has been incredible with Bitcoin zooming above $5,500 and later testing $5,600. A correction is, however, ongoing below the intraday high. BTC/USD is changing hands at $5,571 but the technicals remain strongly positive. We see Bitcoin being able to resume the trend breaking above $5,600 short-term resistance and retracing towards 2019 high at $5,632.

Presently, the RSI is in the overbought region and could mean that the bulls are exhausted because of the failure to rise above $5,600. The MACD in the same 1-hour range is still in an upward slope to show that the bulls still have the power to keep the price above $5,500 in the coming sessions.

BTC/USD 1-hour chart