- The IPO document shows that Bitmain is holding 1.02 million BCH but only 22,082 BTC.

- Bitcoin Cash price is up 2.5% on Monday, buyers psychologically eye $600 in the near-term.

Bitmain is reported to have sold a big chunk of its Bitcoin (BTC) in order to purchase Bitcoin Cash (BCH). The information came to light after a Bitmain pre-IPO investor document was released. According to Samson Mow of Excellion:

“They sold most of their #Bitcoin for #Bcash. At $900/BCH, they’ve bled half a billion in the last 3 months. If Bitcoin Core devs didn’t disclose the Bcash vulnerability, it could’ve wiped a billion dollars off their balance sheets,” Mow wrote on Twitter with regards to Bitmain.

The multi-billion company, Bitmain is currently preparing to have itself listed on a stock exchange, preferably Hong Kong. Similarly, its current market valuation stands at $18 billion. The IPO document shows that Bitmain was holding 71,560 Bitcoin in December 2016. Bitcoin Cash did not exist at this time. In March 2018, the document shows that Bitmain Bitcoin holdings went down significantly to 22,082. However, the company was now holding 1.02 million Bitcoin Cash.

Bitcoin.com says that Bitmain developers have been interested in Bitcoin Cash development lately. In fact, a proposal referred to as ‘Wormhole’ is being discussed. The ‘Wormhole’ is a proposed “layer for building smart-contracts on the Bitcoin Cash blockchain.” Consequently, Bitmain said last week that they are putting $3 million as an investment in a Bitcoin Cash-powered digital advertisement firm.

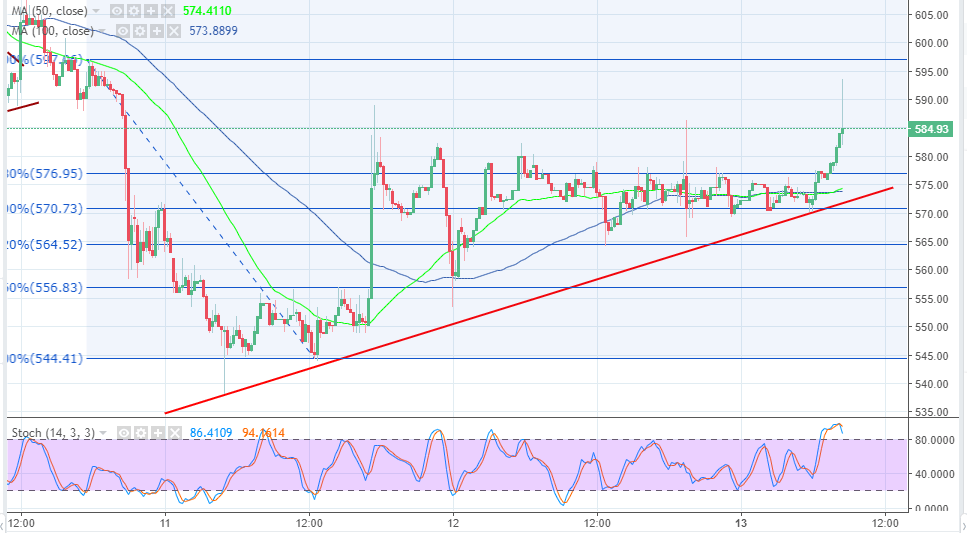

Bitcoin Cash spent the last weekend recovering from the ashes following last week’s acute declines. After trading lows marginally below $545, BCH/USD embarked on an upward roll that unfortunately lost momentum short of $585. The lower reaction that continued during the Asian trading hours on Sunday 12, found support at the 38.2% Fib retracement level with the previous swing low of $544.41 and a swing high of $597.06 at $556.91. A slight recovered followed, although the upside has limited below $580.

Bitcoin Cash settled in a range supported by the 50% Fib level at $560, however, at the time of writing, the buyers are pushing the price higher above $580. It is apparent that $585 will offer strong resistance but a break above this level will see BCH/USD form a clear path towards and beyond $600.

At the same time, technical indicators show that the buyers are getting exhausted from pushing without a catalyst and support above the resistance lines. The price is likely to settle above $580 in the short-term as the buyers gather strength to attack $585 and $600. The 61.8% Fibo at $576.99 will work as support. Other support lines include $570, $565 and $555.