- Bitmain gets ready for a stressful event by streamlining its operations.

- BTC/USD may be less inclined to grow after the halving.

- Currently, the first cryptocurrency has stuck above $7,000.

One of the world’s largest manufactures of Bitcoin mining equipment launched a personnel optimization program. The heads of all departments are supposed to prepare their optimization lists by the annual meeting on January 17.

According to the insiders, Bitmain does not have any financial problems at this stage, while a personnel reduction is an attempt to get ready for Bitcoin’s halving scheduled in May 2020.

The reduction of miners’ remuneration will become a hit for the mining industry; thus, the companies should prepare for the stressful event and streamline their operations while focusing on maintaining the leading edge in technology. Therefore, Bitmain is likely to keep personnel in the mining business and concentrate optimization efforts on AI (artificial intelligence) unit as it does not generate profits.

Notably, after Jigan Wo regained control over Bitmain, the salaries of all employees have been increased. Also, the CEO announced three strategies aimed at lowering entry barriers for miners and thus stimulating sales of the equipment.

Controversial halving consequences

While many Bitcoin enthusiasts bet on Bitcoin’s price increase due to the halving, the chief of China-based bitcoin mining giant is less optimistic about the much-hoped bull run. In October, he said that the upcoming reduction of bitcoin block reward might not trigger substantial price increase.

The previous two halvings in 2013 and 2017 resulted in sharp growth that brought Bitcoin to new all-time highs (ATH). However, this time the market conditions are different. Moreover, the cryptocurrency trading industry has become more mature and attracted many players from traditional finances.

Also, the introduction of derivative instruments loosens the correlation between the price of an asset and its stock to flow ratio. Traders use futures, options and CFDs (contracts for difference) rather than underlying instruments to speculate on price.

BTC/USD: technical picture

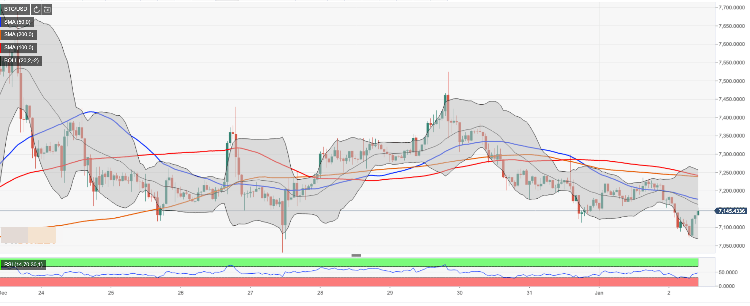

On the intraday chart, BTC/USD has returned inside the Bollinger Band while its lower boundary at $7,070 now serves as initial support that separates us from critical $7,000. Once it is out of the way, the downside is likely to gain traction with the next focus on $6,800 ( the lower line of the daily Bollinger Band).

On the upside, thee initial barrier is created at $7,170. This area includes SMA50 (Simple Moving Average) 1-hour, the middle line of 1-hour Bollinger Band and 61.8% Fibo retracement. We will need to see a sustainable move above this handle for the upside to gain traction and push the price towards $7,500.

BTC/USD 1-hour chart