Dollar/yen had a very choppy week, and eventually managed to push higher. Final GDP results are the highlight of this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week was encouraging for Japan with 1.9% jump in January’s retail sales way above the 0.2% decline expected. Industrial output surged 2.0% , better than the 1.6% rise predicted and Capital spending edged up 7.6%, contrary to the 6.4% drop anticipated by analysts. Nevertheless, the lower prospects of QE3 in the US certainly helped the dollar.

Updates: USD/JPY was down, as the dollar made gains against the major currencies. The pair is trading at 81.18. Average Cash Earnings rose to 0.0%, its highest since November 2011. The yen continues to drop, as it has fallen below the 81 level and is trading at 80.63. GDP figures are awaited.Current Account was very low, at 012T. Preliminary Machine Tool Orders dropped by 8.6%.

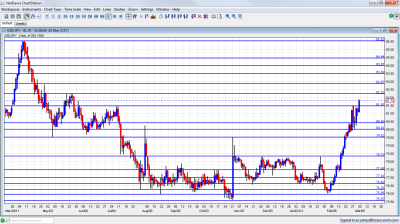

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Average Cash Earnings: Tuesday 13:30. Japanese wage earnings dropped 0.2 % in December from a year earlier following the same decrease in the prior month. Nevertheless this reading was higher than the 0.3% drop anticipated by analysts. The recent drops occur due to the global slowdown and the strong yen. A drop of 0.3% is expected now.

- Leading Indicators: Wednesday, 5:00. Japan’s leading index climbed 0.6 points to 94.3 in December from November, raising hope for an economic improvement in the future. Meanwhile the coincident index measuring current economic conditions increased to 93.2 from90.3 in November. A further climb to 95.1 is predicted.

- Final GDP: Wednesday, 23:50. Japan’s economy expanded by 1.4% in the third quarter lower than the preliminary 1.5% rise due to weaker capital investment and consumer consumption. A drop of 0.2% is expected this time.

- Economy Watchers Sentiment: Thursday, 5:00. Japanese service sector sentiment for current economic conditions dropped to44.1 in January from 47.0 n December due to the strong yen and bad weather. However the government believes economy is recovering moderately. An increase to 46.3 is forecasted.

- M2 Money Stock: Thursday, 23:50.Japan’s domestic cash in circulation increased 3.0% in January from a year earlier from a revised 3.2% rise in December less than the 3.1% growth predicted by analysts. Another rise of 3.1% is expected now.

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen started with an early failed attempt to break above the 81.50 line (mentioned last week). It then slid and fought over 81.50. Another attempt on 81.50 was initially capped, but finally the pair rose and close at 81.80.

Technical lines from top to bottom

85.50 is still far, but it’s getting closer once again. This was a peak after a strong move in March 2011. It held for more than one day. 84.50 capped the pair at the end of 2010 and at the beginning of 2011 and is also an important line.

An important line of resistance is found at 84, which capped the pair back in February 2011. It is closely followed by minor resistance at 83.50.

82.87 was the line where the BOJ intervened in September 2010, and also worked in both directions afterwards. 82.20 was a stubborn peak in May 2012 and is now closer. It is likely to be strong resistance.

81.50 was a clear line of resistance that marked the big fall in the summer and now switches positions. 80.50 temporarily capped the pair in the surge of February 2012, and then served as a battle line.

The round number of 80, which provided strong support in June, is the next line, and it is of high importance. 79.50, is now a battleground. This is the line that was reached after the last non-stealth intervention.

78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. After it was broken, the rally intensified. It now switches to support. 77.50 is weaker now. It worked well also in October and the surge in February 2012 didn’t provide a clear break.

The round number of 77, is a significant cap once again and was only temporarily breached. It’s followed closely by 76.60 which was a significant line of support at the beginning of 2012. Once it was broken to the downside, any attempts to move higher will be capped by this level.

I am bullish on USD/JPY.

Lower prospects for QE3 in the US, higher yields and the Japanese trade deficit point to higher ground for the pair. The yen can enjoy an upwards revision of GDP, but the longer term trend is higher.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.