The New Zealand dollar fell to levels last seen at the beginning of the year, but managed to make a remarkable recovery as well. Current Account and GDP are the main events this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Some positive figures were released with a rise of 0.8% in house price index, Food price index gained 0.6% after a flat reading in January and Manufacturing sentiment increased to 57.7 from 50.8 in January indicating improvement in NZ market activity. Will this positive trend continue?

Updates: Westpac Consumer Sentiment rose slightly, to 102.4. NZD/USD is down, trading at 0.8168. The markets are awaiting the GDP release. Current Account came in at -2.77B, just as the markets predicted. Visitor Arrivals dropped by 4.9%. Credit card spending jumped 4%, up from 3.1% last month. GDP rose a modest 0.3%, below the market forecast of 0.6%.

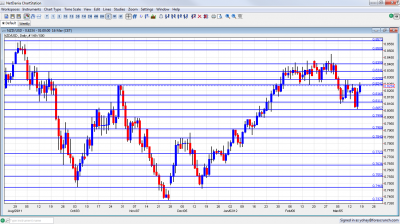

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Westpac Consumer Sentiment: Sunday, 21:00. Household sentiment plunged in the fourth quarter to 101.3 from112 in the previous quarter. Sentiment has been dropping since the earthquake on Christchurch resulting is lower consumer spending and not rate hikes. Nevertheless, business confidence rise for the first time in months providing careful optimism.

- Current Account: Tuesday, 21:45.New Zealand’s Current Account deficit increased more than expected in the third quarter to 4.6 billion from -0.920 billion in the previous quarter. Analysts predicted a smaller deficit of 3.775 billion suggesting contraction in NZ economic activity. Current Account deficit is expected to improve to 2.81 billion.

- Credit Card Spending: Wednesday, 2:00. Credit card spending in New Zealand increased 3.1% in January on a yearly base, less than the 5.9% rise predicted by analysts. On a seasonally adjusted monthly basis, credit card payments increased 0.8% following 0.9% gain in the preceding month.

- GDP : Wednesday, 21;45. GDP expanded 0.8% in the third quarter partly due to the Rugby World Cup spending and manufacturing. Manufacturing increased 2.3% and household spending gained 1.5% while business investment was down while. However this is only a temporary growth caused by the Rugby World Cup tournament. GDP is expected to grow 0.6% in the fourth quarter.

* All times are GMT.

NZD/USD Technical Analysis

After an initial dip, NZD/$ made a failed attempt to break above the 0.8240 line (mentioned last week). This sent the pair down to find support around 0.8060, before rising once again and closing just under the 0.8240 line.

Technical lines, from top to bottom:

0.8573 was a stubborn line of resistance during August 2011 and remains of high importance. 0.8505 was a peak on the way up during July. A move higher in February 2012 fell short of this line.

The 0.84 line separated ranges in August 2011, and earlier served as support when the kiwi traded higher. While this line was hurt recently, it still serves as a serious cap. 0.8340 was a peak in September and now returns to support. It was a tough line of struggle in February 2012.

0.8280 is a new line, that capped the pair in a stubborn manner during March 2012. 0.8240 was a peak in October and also back in May 2011. It proved its strength in January 2012 and also in March 2012 as a strong resistance line.

Moving lower, we find 0.8165. It provided support for the pair at several occasions, last seen in October. After being crossed passed a few times, its strength is diminishing. 0.8110 switched positions from support in August to resistance later on and is a minor line, now on the way down.

0.8060 was resistance in October and support beforehand.. It was also tested in January and in March, this time as support. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is now stronger resistance after capping a rise at the beginning of 2012. 0.7840 worked as cap for a range and earlier stopped the pair in October. It then became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and is now minor support. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January.

I remain bearish on NZD/USD

With no QE3 in the US, and growing worries about China’s strength, the kiwi has room to fall. Another dip might be stronger than this one.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.