NZD/USD slid within the same range, erasing previous gains. The rate decision is the highlight of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD

Last week New Zealand’s consumer price index increased in the first quarter by 0.5% following a 0.3% decline in the 4th quarter of 2011. The rise was mainly due to an increased taxes on tobacco. The reading was in line with analysts’ expectations and also supporting the prediction that the central bank will keep rates at 2.50% until the end of 2012.

Updates: The New Zealand dollar is weakening, as the NZD/USD trades close to the 0.81 level, at 0.8108. Visitor Arrivals will be released later on Monday. NZD/USD is steady, as the pair is trading at 0.8122. Visitor Arrivals posted a strong reading of 2.3%, after two consecutive declines. The increase was especially welcome after the dismal March reading of -4.9%. Credit Card Spending improved in March, jumping 5.2%. The Official Cash Rate will be published later on Wednesday. Look for the central bank to maintain rates at their current level of 2.5%. NZD/USD has edged higher, trading at 0.8159. As expected, the Reserve Bank of New Zealand did not adjust interest rates, maintaining the Official Cash Rate at 2.5%.

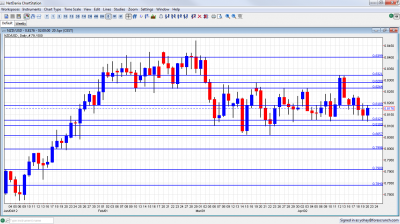

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Visitor Arrivals: Monday, 22:45. International travel in NZ dropped 4.9% in February following 3.3% decline in the previous month. The decrease in visitor arrivals was partly due to the Chinese New Year holiday period being in January in 2012.

- Credit Card Spending: Tuesday, 2:00. New Zealand credit card spending increased for a third straight month in February rising 4.0% after 3.1% in January The main cause for this rise was an increase in domestic billings, indicating improvement in consumer spending.

- Rate decision: Wednesday, 21:00. New Zealand’s central bank maintained its official cash rate for an eight consecutive time inflation rate is satisfactory and does not require monetary policy changes. “Sustained strength in the New Zealand dollar will ensure no future rate hikes until December. No change in rates is expected this time.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/$ started the week a bit lower, then moved towards 0.8240 before turning lower and finding a bottom around 0.8120. The pair eventually closed at 0.8176, lower than last week.

Technical lines, from top to bottom:

0.8573 was a stubborn line of resistance during August 2011 and remains of high importance. 0.8505 was a peak on the way up during July. A move higher in February 2012 fell short of this line.

The 0.84 line separated ranges in August 2011, and earlier served as support when the kiwi traded higher. While this line was hurt recently, it still serves as a serious cap. 0.8320 capped an attempt for a surge in April 2012 and is now of stronger importance.

0.8290 capped the pair in a stubborn manner during March 2012, and set the pair falling. 0.8264 capped the pair as a double top in both March and April 2012 and proved to be quite strong.

0.8190 is the next line. It capped the pair in March 2012 and also provided some support in January. 0.8124 worked as a significant cushion during April 2012 and also beforehand and is now strong support.

0.8060 was resistance in October and support beforehand.. It was also tested in January and in March, this time as support and provided to be very strong. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is now stronger resistance after capping a rise at the beginning of 2012. 0.7840 worked as cap for a range and earlier stopped the pair in October. It then became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and is now minor support. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January.

I remain bearish on NZD/USD

Expectations for QE3 in the US remain too high, and reality might bite. On the other side of the Pacific, the rate decision in New Zealand might be more bearish, especially with the Chinese slowdown.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.