Euro/dollar continued its recovery from Friday but met resistance and fell back. Polls in Greece show that the elections certainly look like a referendum on the euro membership. In Spain, the talks about a bailout refuse to leave. Is the correction over?

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

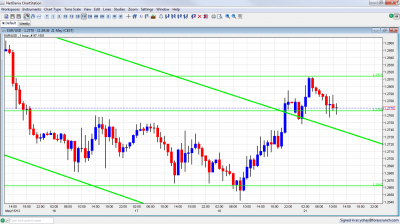

- Asian session: EUR/USD continued recovering, reaching resistance at 1.2814 and falling back.

- Current range: 1.2660 to 1.2760.

- Further levels in both directions: Below: 1.2660, 1.2623 and 1.2587.

- Above: 1.2760, 1.2873, 1.29, 1.2960, 1.30, 1.3050, 1.3110, 1.3165, 1.3212, 1.33 and 1.34.

- The pair broke out of the steep channel (seen on the daily chart here) but is making its way back in.

- 1.2814 was temporary support and now strong resistance.

- The year to date low of 1.2623 is the critical cliff. In historic terms, 1.2587 below is even more important.

Euro/Dollar limited recovery – click on the graph to enlarge.

EUR/USD Fundamentals

- 9:15 US FOMC member Dennis Lockhart talks. Rejected QE3 for now.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Greek polls look like euro-referendum: Center right mainstream party New Democracy is now head to head with the anti-bailout party SYRIZA. Both are gaining ground in the polls while other parties are weakening. The party that wins gets extra 50 seats in parliament and could break the political deadlock seen so far.

- Grexit wheels in motion: Even if a pro bailout party is elected, the wheels of a euro-exit are already in motion. Greeks are withdrawing money from banks (still a “jog” rather than a “run”). Others are deferring their tax payments, and also the electricity company in charge of collecting property taxes just doesn’t collect them. Greece’s coffers are a bit dry. How long can this juggling continue?

- Bailout for Spain?: The euro-area’s fourth largest country could get a bailout for its banks or for itself. Talk about this option was seen over the weekend and is adding pressure. This comes after Moody’s downgraded 16 Spanish banks, including Santander, BBVA and Caixabank, who all received an A3 rating. Spain may need to use its “plan C” for a worsening situation is underway sooner than later. Moody’s also downgraded a few Spanish regions..

- G-8 Leaders Want Greece in the Euro-zone: The meetings in Camp David yielded no dramatic declarations. Regarding Greece, all leaders said they want to see Greece in the euro-zone, but that’s not new. Where they working on contingency plans behind the scenes. See how to trade the Grexit with EUR/USD.

- Italian economy free falling: The euro-zone’s third largest country is squeezing fast: 0.8% in Q1 – a third consecutive contraction. Italy is away from the limelight for now. Germany’s outstanding growth, 0.5%, saved the euro-zone from a recession..

- US Economic Strength Questionable : Also US data has been leaning lower: weak retail sales and the negative Philly Fed Index are quite worrying, but the NY Fed Index was good and jobless claims are falling. Uncertainty is high.

- Fed Not Keen to Act Soon: Troubles in the euro-zone and the mild growth in the US aren’t enough to trigger action from the Fed, not yet. A bigger fall is necessary.