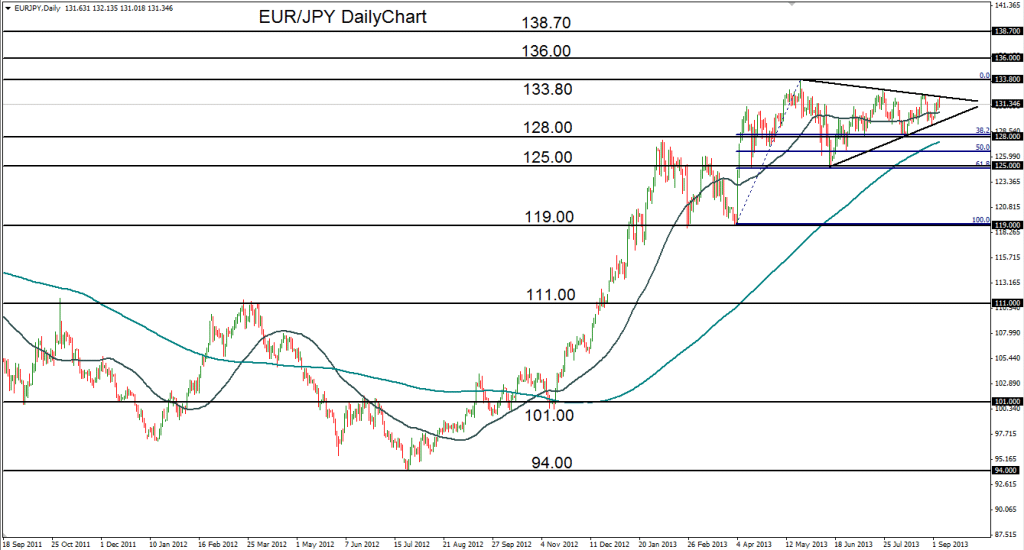

September 5, 2013 – EUR/JPY (daily chart) has continued its consolidation within a large and clear triangle pattern. This pattern occurs within the context of a strong bullish trend extending back to the July 2012 low around 94.00. It also occurs after this bullish trend peaked at 133.80 in late May. Since that peak, the last three months have seen a converging consolidation in the form of the triangle pattern.

The pair is currently near the top of the pattern, potentially seeking a breakout to the upside. Price action is above both the 200-day and 50-day moving averages, both of which are indicating a continued bullish trend bias. With major downside support around the bottom of the triangle and then the 128.00 price region, the key technical event to watch for would be a breakout above the triangle, in which case the immediate resistance objective to the upside would be the noted 133.80 peak. Any breakout above that high would confirm an uptrend continuation with further objectives around the 136.00 and then 138.70 resistance levels.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.