The Japanese yen managed to strengthen against the US dollar after the Federal Reserve surprised by deciding NOT to taper bond buys.

The dollar fell across the board, but the reaction against the yen was quite limited. And after the initial drop of USD/JPY, it made a big bounce higher from uptrend support, erasing most of the drop. Can the pair continue rising? Here are 5 reasons for the yen’s weakness.

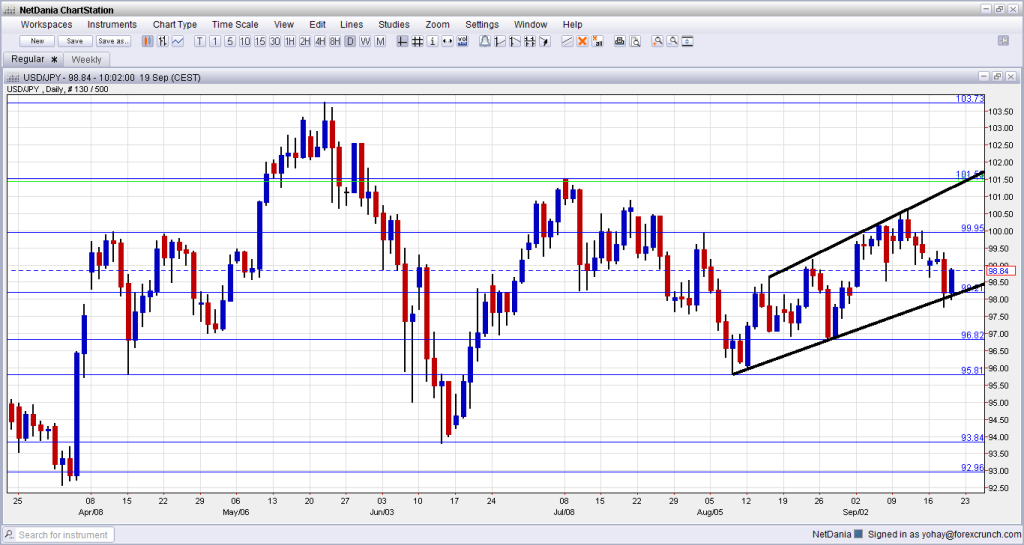

The uptrend support line can be seen as forming during August (bottom thick black line on the chart):

While the pair dipped below the line in recent days, it didn’t close at the lows. The initial response to the Fed was a big drop all the way down to 97.76. At the time of writing, the pair is already back to 98.88 – around the pre-crash levels.

The next serious line of resistance is only at the very round number of 100, followed by 101.50. Support is found at 98.20. It was breached during the storm, but regains its importance as support. Further below, 0.9660 is the next line.

Why did we see a weak reaction?

Here are 5 explanations:

- US yields dropped in a natural reaction to ongoing QE, but didn’t fall too far. The 10 year yields are closer to the recent peaks and quite far from the lows that were seen before the Fed began talking about tapering in May and June. Stronger US yields are supportive of USD/JPY.

- Japanese stock markets: The rise in the Nikkei index (as well as in all stock markets across the world) was accompanied by a rise in dollar/yen. This is a very common behavior, and isn’t surprising.

- Japan considers scrapping a tax: While the hike in the sales tax seems to be on track, the special post 2011 tsunami tax might be lifted, according to reports. More stimulus for Japan also weakens the yen.

- Risk on: The general mood in the markets is positive as the easy money flows form the US. In this atmosphere, the safe haven yen is not sought after, but rather sold off in favor of other currencies with higher yields, such as the Aussie and the kiwi. This also weighs on the yen.

- Rising oil prices: Since the 2011 catastrophe in Fukishima, Japan has become reliant on imports of energy as nuclear faciliteis were shut down. Consequently, its trade balance became negative in the past 14th month. A fresh release of Japanese trade balance made just after the Fed announcement, confirmed the ongoing deficit. With no delay in QE money, oil prices can continue rising and this can widen the deficit.

What do you think? Can USD/JPY run to 100?

For more on the yen, see the USD JPY forecast.