Idea of the Day

It was the euro taking a turn for the worse yesterday. Its vulnerability was already illustrated in the wake of the Fed decision as it was the weakest performer, but the weaker CPI for the Eurozone meant that expectations of action from the ECB before year end were enhanced. Expectations were already building for a new lending operation for the ECB in the early part of next year, but the CPI data increased the view that we could see the ECB cut its benchmark rate before the year is out. This could mean that we are in for a period of reversal on the euro, especially on some of the crosses such as EURJPY. The game has shifted as we head into next week’s ECB policy meeting and the one thing to remember is that the currency ECB President has been a lot more active than the last one when it comes to changing policy when needed.

Data/Event Risks

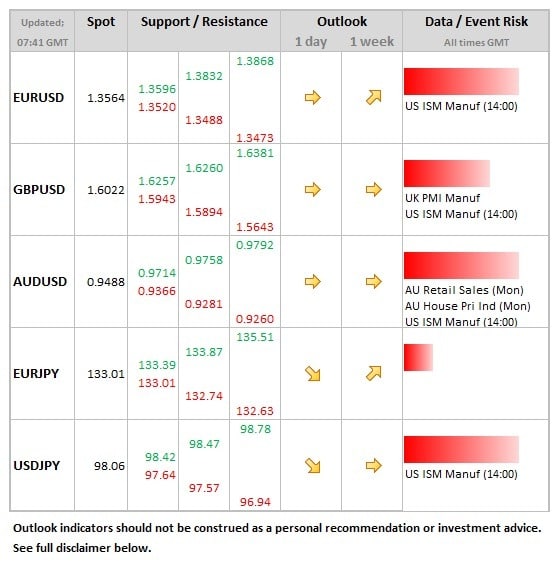

GBP: There was no stopping the manufacturing PMI numbers earlier in the year, rising every month from March to August. This trend was reversed in the September data, with expectations for a marginal fall in today’s numbers from 56.7 to 56.4.

USD: The ISM manufacturing data will be one of the first reads of economic sentiment during October’s shutdown. Markets expect a fall from 56.2 to 55.0, but volatility risks are greater than usual for this release.

Latest FX News

JPY: The yen the outperforming in the overnight session, USDJPY dipping briefly below the 98.00 level, but no real fundamental trigger to the move. It did allow for a further push lower on EURJPY below the 133.00 level.

EUR: Slipping as expectations of ECB action increase, although cracks were already appearing before the weaker than expected inflation data, which showed the headline rate at 0.7%.

AUD: The Aussie finding a base around the 0.9450 – 0.9500 area in the latter half of the week, helped by stronger data yesterday. Overnight, Q3 PPI rose 1.3% according to data released overnight which also served to support the currency.

Further reading:

EUR/USD Nov. 1 – Free fall continues on rate cut expectations

EUR/USD getting close to critical uptrend support – bounce or breakdown?