Idea of the Day

The next two days belong to sterling. Inflation data is released today, with labour market data tomorrow (now an ‘intermediate target’ for the Bank of England) with the Inflation Report following after. All this could determine sterling’s fate vs. the USD, as the 1.60 level continues to be a tough barrier to break on a sustained basis. Today’s inflation numbers are seen falling on the headline rate to 2.5% (from 2.7%). Tomorrow’s events are likely to be more crucial for sterling, given that it is labour market developments that are likely to dictate when the bank starts raising interest rates.

Doubt was raised in August when the first projections for the unemployment rate were first published (seeing the threshold of 7.0% reached in early 2016) and the Bank is likely to acknowledge that the pace of improvement is likely to be quicker than initially anticipated. If this is combined with firmer than expected inflation numbers today, then sterling should be poised for a more sustained push above the 1.60 level vs. the USD.

Data/Event Risks

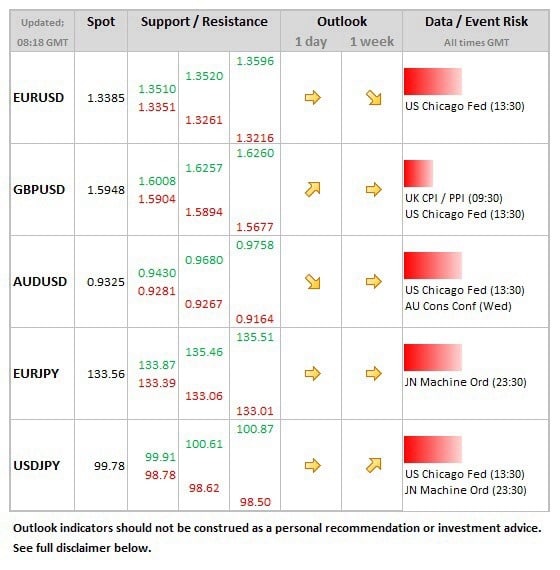

GBP: CPI is the main release to watch, seen moving back towards the 2% target, from 2.7% to 2.5%. Also released will be PPI data, reflecting inflation at the factory gates (both input and output prices). Higher than expected numbers overall should give sterling the impetus to push back above the 1.60 level against the US dollar.

Latest FX News

USD: A more consolidative tone emerging after the volatility seen towards the end of last week. No key data releases scheduled for today so impetus coming from elsewhere, but budget talks are due to start in Washington on Wednesday, so that issue will slowly come back into the frame.

EUR: A consolidative session on Monday with a slight upside bias. There is a case for suggesting that the impact of last week’s rate cut on the currency could ultimately be limited, given the small move in actual market rates.

AUD: The Aussie feeling a little tired, having fallen vs. the USD for the previous 3 sessions. There is also an underlying sense that the currency is more prone to react to bad rather than good news, fearful of more comments from the RBA on a push to the upside.

Further reading:

GBP/USD: Trading the British Claimant Count Change

EUR/USD Nov. 11- Remains Under Pressure As Non-Farm Payrolls Sparkle