Back Tests and Forward Tests

It’s not easy to sell a MT4 Forex Trading Robot these days. Previously, developers could simply display only the back test results, which allows much back-fitting and backward-looking optimization, only to fail on forward tests.

With forward testing publishers such as myfxbook andmt4i, you will notice that most commercial robots now have to display live forward test performance, often with real capital. This is generally great for the expert advisor industry because developers will have the incentive to develop software that works in the future, and customers get a better sense of how the software performs in real market conditions.

Expert Advisor Evaluation at a Glance

This article discusses how we can quickly determine and understand an MT4 forex expert advisor, just by looking at the trading results and performance graph. For the sake of discussion, we will be looking at some famous commercial robots and screen shots of their myfxbook performance.

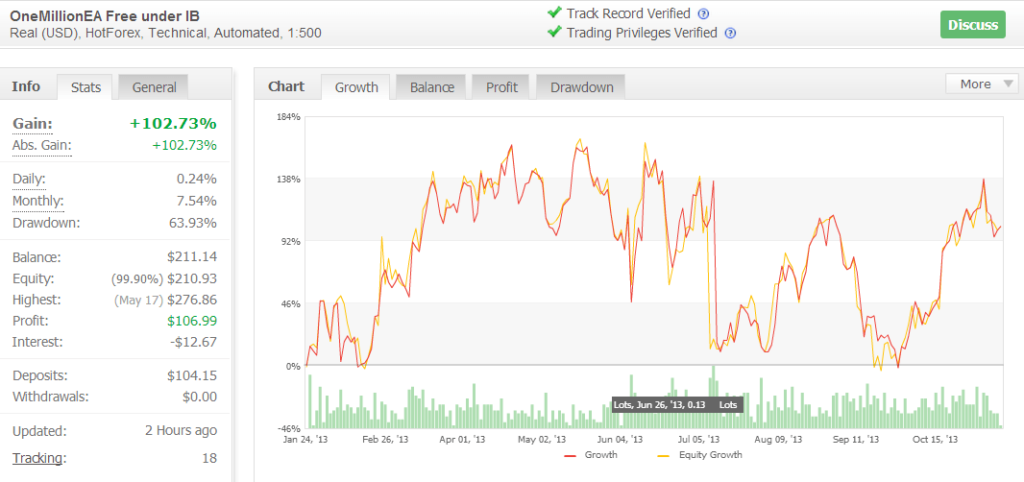

Heading No Where

The performance below is that of “OneMillionEA” for 2013 year to date. At a glance this robot seems to be headed no where, with an equal chance of wins and losses. A drawdown of 64% certainly grants this robot a risky status. That said, this EA still commands over 100% return so far, it sure has the ability to recover, but lacks the general upward slope which appeases most traders.

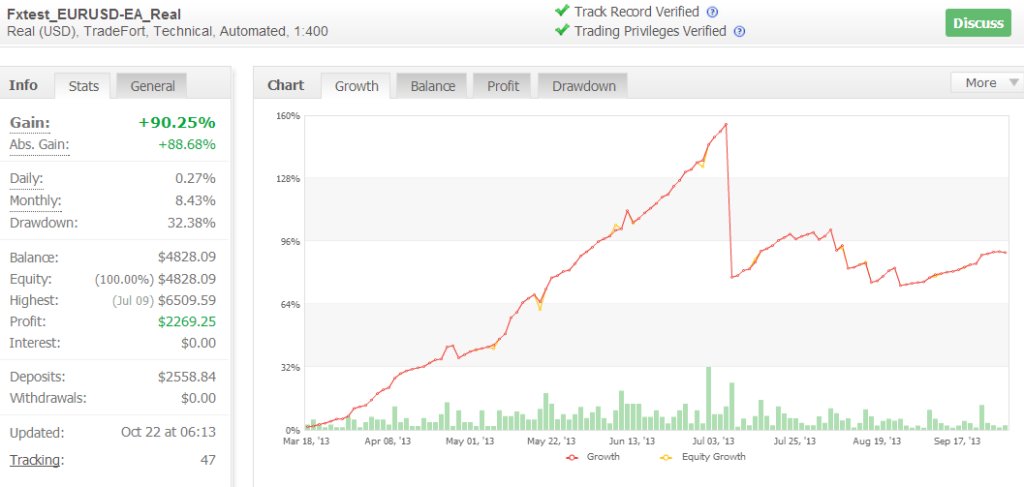

Stepping into Quicksand

Next, we check out the performance of “Fxtest_EURUSD”, this time the drawdown is lower at 32% over a shorter trading period, with less volatility. The downside is the sharp drop which wiped away 2 months of profit. Notice that the green bar, representing volume traded, spiked up just before the fall in profits? This robot likely has money management in play which possibly increased position size along with size of account balance. That led to a sharp fall larger than normal, and this EA has failed to recover ever since. The potential shock in trading performance should impart some discomfort to most traders.

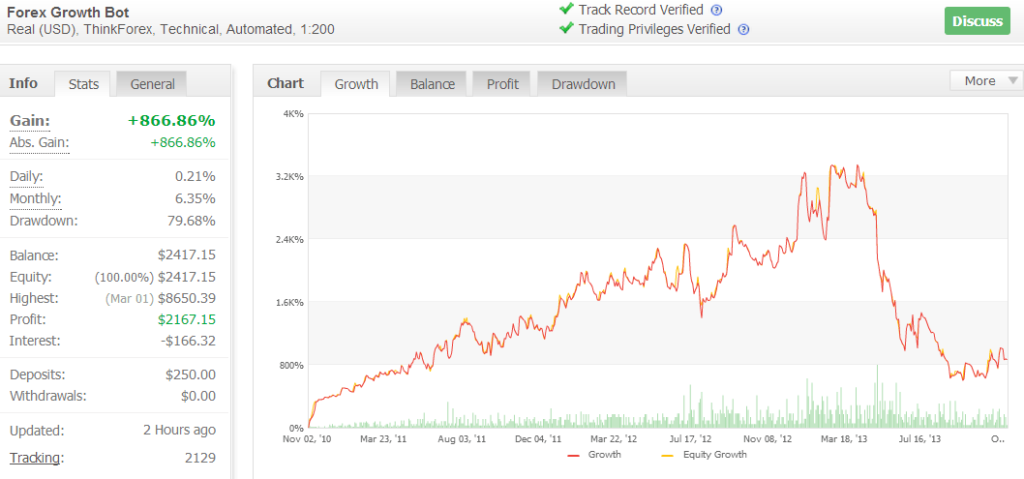

Past performance is not an indicator of future performance

If there is one chart for the header above, it is the performance of “Forex Growth Robot”. This Ea performed well from Nov 2010 to March this year, and thereafter we see 2 years of profit wiped out. Unlike the stock market, it is difficult to predict the “market top” when trading an expert advisor. So if someone were making 3000% profits over 2 years, he will likely continue and any one trading this system would like lost much, depending on when he started. The lesson to take away here is not to put all our eggs in one basket but diversify with a portfolio of robots. This strategy does not seem to work any more.

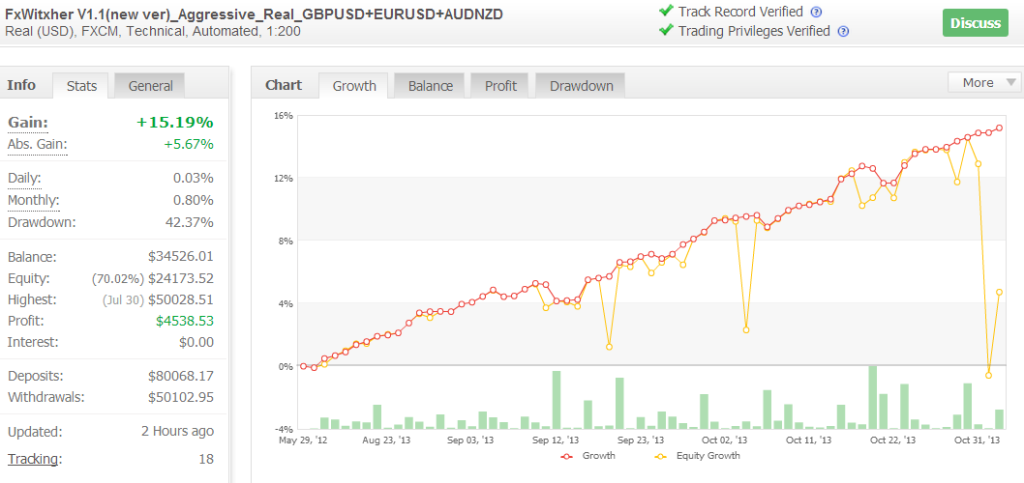

What you see is not what you get

Below is the performance of “FxWitxher”. Just looking at the balance growth in red, this robot is great with a general upward slope. But look at the corresponding yellow equity growth and just last month it touched zero. This robot seems to be holding on to losing positions for a long time until it makes a profit, exposing the trader to the risk of a margin call. It will be better if the equity curve does not deviate too far from the balance, that way you know there’s probably a stop loss in place to prevent holding on to losers.

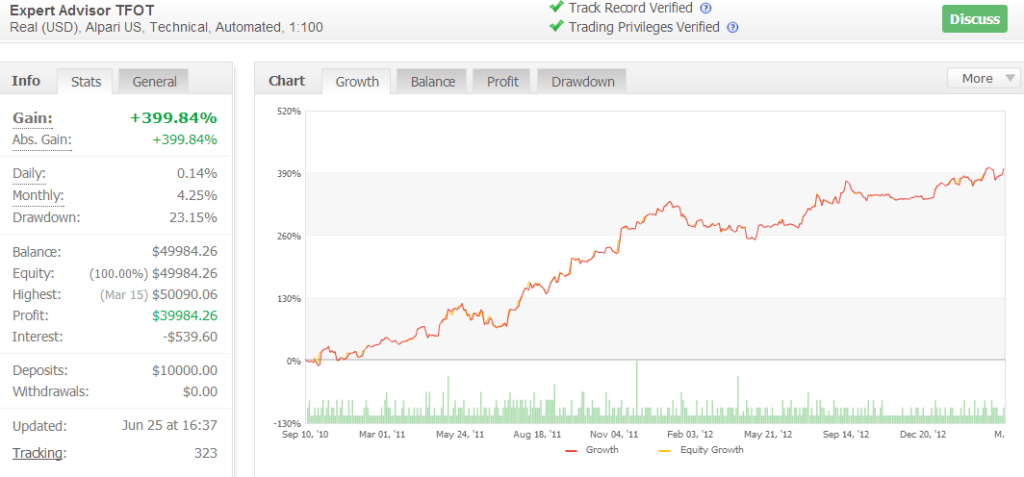

What looks good

With so many negative examples above, we think the performance of “TFOT” below looks very decent. With a drawdown of 23%, a general upward sloping curve without shocks to balance or equity, this robot seems to have proved itself for over 3 years. We also like to see both wins and losses, which likely implies a sound strategy in play, as opposed to plain grid or martingale systems which paint a straight upward curve.

Written By: Streetpips.com

Profile bio: Streetpips.com scans books and websites for trading strategy ideas. We then select those which are programmable, code them, and share these with our members.