Idea of the Day

Friday, month end and the continuation of the US Thanksgiving holiday make for a quite but also potentially choppy end to the week. It was apparent yesterday that markets were not willing to push the dominant trends of the month, namely yen weakness, contrasted by strength in both the euro and sterling. The market was also reluctant to push the Aussie to new lows. On balance, the same is likely to hold true today, but some caution is always warranted on the last trading day of the month, as bigger funds adjust positions and also adjust to benchmark changes, which can cause some choppiness in markets, including FX.

Data/Event Risks

GBP: Data out today is unlikely to impact sterling, but numbers on mortgage approvals will be of interest as more focus is on the housing market and the extent to which the government’s help to buy scheme is boosting both lending and prices (see Nationwide data overnight).

Latest FX News

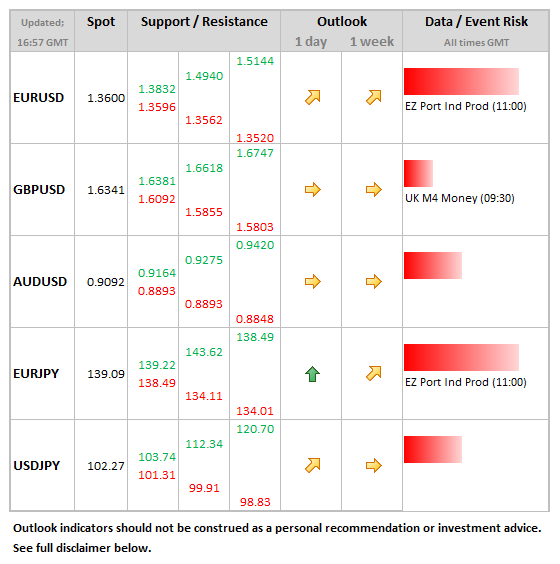

JPY: Inflation data was released overnight which showed a further gradual improvement in the picture. The headline rate came in as expected, holding steady at 1.1% on the YoY measure, with the ex-fresh food measure rising 0.9%. The Tokyo data for November was firmer than expected, suggesting more strong data could be on the way for November. The yen initially weakened to 102.6 on USDJPY, but strengthened down to 102.2 towards the end of the Asia session.

EUR: Holding to a tight range during the Asia session, largely within the 1.36 to 1.3620 range for EURUSD. It’s worth noting that the ratings agency S&P moved Spain’s rating outlook to stable, whilst the Netherlands was the latest nation to lose its triple-A badge. EURJPY saw a high of 139.71 overnight.

AUD: The Aussie pushed below the 0.91 level on AUDUSD, touching a low of 0.9056 before recovering to just below 0.91. Domestically, government’s rejection of US company (ADM) takeover of GrainCorp weighted on the currency a little.

GBP: Finding some further strength in the latest rally during Asian hours, marking out a high of 1.6374 on cable, before resting back to 1.6351. The high for the year is at 1.6381, seen on 2nd January. Latest house price data from Nationwide showing prices rising by 6.5% on annual measure, from 5.8% previously.

Further reading:

EUR/USD Nov. 29 – Steady Despite Sluggish German Retail Sales