Idea of the Day

After weaker than expected GDP data overnight, the Aussie is very close to breaking below the 0.90 level and potentially shaping up for a test of new yearly lows before the month and year are over. The Australian Treasurer described the economy being stuck in second gear, but at a quarterly rate of 0.6%, although this is a rate of growth many European economies would be envious of. But the shift away from mining investment that had been such a lynchpin of growth in recent years is serving as a major challenge for the economy, one that could well require lower rates from the central bank in the early part of next year. We’ve pointed out many times the way in which the Aussie has been trading less like a commodity currency and today’s data underlines that point, lining up the currency for further weakness in the early part of 2014.

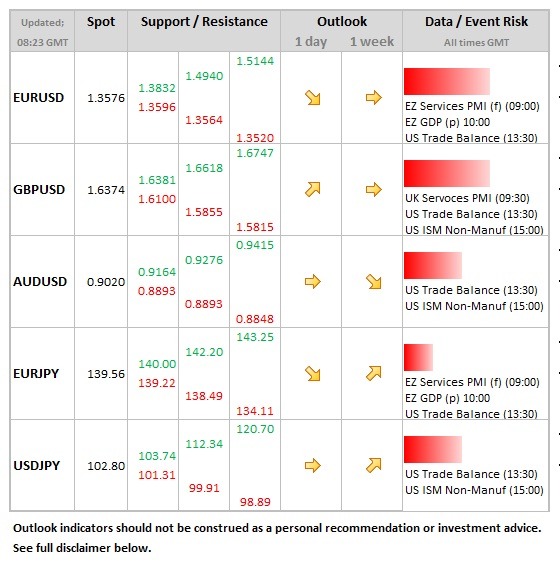

Data/Event Risks

EUR: Final PMI data for the services sector will warrant some caution, given that it was the weaker Spanish numbers on Monday that prompted the sell-off in the single currency. Spain is seen at 49.7, with the Italian series seen holding above 50 at 50.4. France is also in focus, given signs of a renewed slowdown of growth into the end of the year. GDP data for Q3 also released (second estimate), seeing rising 0.1% on the quarter.

GBP: Both the manufacturing and construction PMI have come in better than expected this week, so expectations are for the services series to do the same, even though the official market expectation is for a move lower, from 62.5 to 62.0. Sterling would react positively to a number 62.5 or higher, but gains could struggle to be sustained, especially above the 1.64 level on cable.

Latest FX News

EUR: A decent performance by the euro on Tuesday, climbing back above the 1.36 level on EURUSD. This looked to be largely a correction from the fall seen on Monday in wake of the weaker Spanish PMI data. With the ECB meeting tomorrow, there remains a reluctance to push new highs, given the risk of hints of further easing measures to come.

GBP: Another short-term boost for sterling yesterday from the better than expected construction PMI data, which moved ever higher. But the gains were transitory above the 1.64 level, which now appears to be the new short-term barrier, above which sterling could be struggling for air.

AUD: The weaker than expected GDP data taking one big figure off the Aussie, down to an overnight low of 0.9033. A move below the 0.90 level has not been seen since the early part of September.

Further reading:

Chatter BoJ looking to expand stimulus boosts USD/JPY only temporarily

Canadian dollar dips to 3 year low against the USD