Idea of the Day

Today’s US employment report the last piece of key data before the FOMC meeting on December 17/18. The labour market remains pivotal in determining when the Fed starts reducing the monthly amount of bond purchases it undertakes. If today’s data is much stronger than expected, then the dollar is likely to appreciate on the growing risk that the Fed starts to taper purchases as early as this month. Over the past few weeks, the Fed has convinced markets that tapering does not mean tightening of interest rates, which was a fear that prevailed back in September. This could well make the Fed more confident in treading down the tapering path than was the case before. This would be dollar positive, of that there is no doubt, but the upward pressure on the dollar would be more contained than if the Fed had not convinced markets of the difference between tapering and tightening, so long as expectations of higher interest rates don’t start to build as a result.

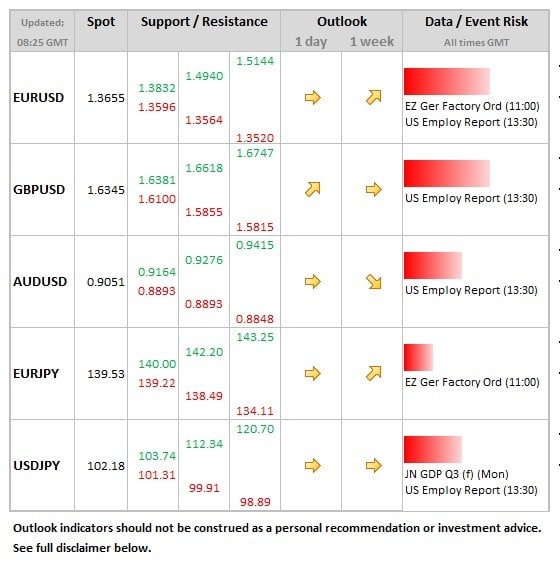

Data/Event Risks

USD: In essence, the first employment report for 3 months not impacted by the government shutdown or the anticipation of it. Expectation is for headline payrolls to increase by 185k, with the risks to this on the upside after the stronger ADP numbers seen on Wednesday. The dollar will be more sensitive to stronger data on the basis that a December tapering remains a decent possibility.

EUR: Just German factory orders data this morning, which are seen falling 1% after a 3.3% gain in the prior month. Data has to be fairly far from expectations (2% or more) to have impact on the single currency.

Latest FX News

EUR: The euro was higher after the ECB decision and press conference on the basis that Draghi did not introduce any further easing measures. The firmer tone has largely been retained, EURUSD holding above the 1.3650 level during the Asia session..

JPY: The firmer dollar tone seen during the Asian session has allowed USDJPY to claw back above the 102.00 level. Yen remains fearful of the Government Pension Investment Fund buying less domestic debt and this was one factor pressuring the yen lover overnight.

GBP: Moving down towards the 1.63 level in the wake of the weaker than expected US data yesterday. House price data from the Halifax this morning showed 3M annual measure rising to 7.7% (from 6.9%).

Further reading:

Forex Analysis: AUD/USD Extends Declines Down to Key Support

Excellent US data: Q3 GDP revised to 3.6%, jobless claims fall to 298K – USD rises