Idea of the Day

The single currency starting the week above the 1.37 level and again defying expectations that the state of the Eurozone economy would weigh on the currency. One of the factors supporting the currency has been the creep higher in money market rates. This has been caused by banks repaying long-term loans early ahead of the ECB’s bank stress tests. Excess liquidity has been reduced, which has, in turn, put modest upward pressure on market interest rates. Another factor was the lack of further action from the ECB to counteract this tightening, causing a bounce in the euro after the press conference last week. The upward pressure could well continue in the near-term, but the Fed meeting next week is the main risk event on the horizon, given the potential for tapering to start as early as this month.

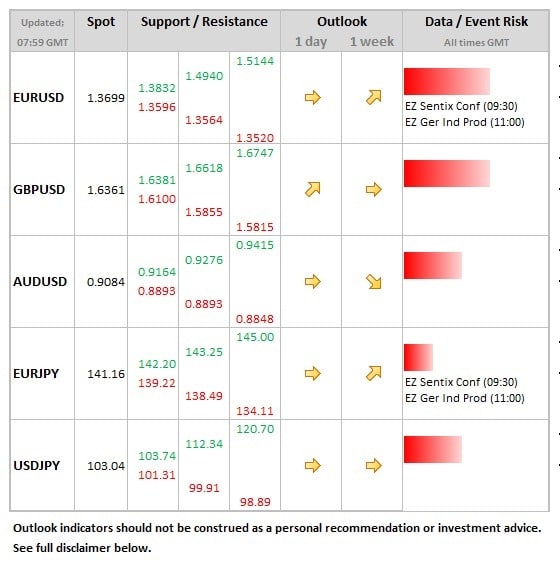

Data/Event Risks

EUR: German industrial production data the main focus for Monday. Recovery expected after fall in September, with a gain of 0.7% seen in the month. If seen, further strength could give some support to the single currency.

USD: Some of the more hawkish Fed members are due to speak today (Bullard, Fisher) and comments could offer some support to the dollar after recent stronger data, keeping alive the potential for tapering as early as this month.

Latest FX News

EUR: Above the1.37 level during the Asian session and technical picture is also supportive for further gains, trendline support coming in at 1.3639.

USD: Progress on a new budget deal means that we could see one signed this week, which would be a mild positive for the dollar ahead of the Fed meeting next week.

JPY: Last week’s USDJPY high of 103.38 is the initial focus this week. There was a small downward revision to GDP in the Q3 final data released overnight (to 0.3%), which added to yen weakness.

Further reading: