Ideas of the Year

A look into 2014 for our last Daily Brief of the year. Our strongest conviction is with the Aussie, seeing it near the 0.80 level towards the end of 2014. The RBA could well be easing rates once again and the traditional dynamics of the Aussie from the boom in China have been waning for some time. We see the dollar around 4% higher on the dollar index, moving down to 1.33 on EURUSD by the end of the year. But we think the euro could well be firmer in the first part of 2014, possibly touching the 1.40 level before the firmer dollar takes hold. The yen we see weaker, but the pace of depreciation will be nothing like that seen earlier in the year. It will be tough to see gold pushing higher against the backdrop of rising yields in the US and continued lower inflation. For that reason, a move down towards the $1,000 level is likely before some support is found. See our blog page for more thoughts for 2014.

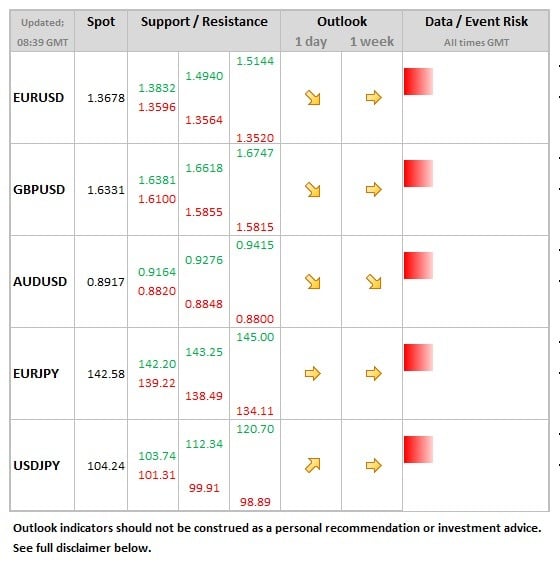

Data/Event Risks for 2014

USD: The main risk is from the economy because if this fails to perform, the Fed will have to reverse the tapering that started early 2014.

EUR: Two main risks for the euro. The first is that rising bond yields in the US force Eurozone yields higher and cause funding issues in the periphery once again. The other is that we see further price falls in the periphery and Europe falls into a deflationary trap which the ECB is powerless to do anything to counteract.

GBP: Sterling was one of the best performers on the majors in the second half of 2014, as the economy surprised to the upside. This momentum will be difficult to sustain in the early part of 2014, as the dynamics of the economy change, which cannot rely in 2014 on consumers running down savings.

JPY: Most of the second half of 2013 was characterised by frustration that the yen was not weaker. It depends on the extent to which the dynamics seen forcing the yen lower disappoint. We see USDJPY at 109 by the end of 2014, but the main risk is that the government continues to disappoint with reforms and investors lose faith once again in Japan‘s ability to pull itself away from deflation long-term.

Further reading: