The Australian dollar had already fallen from the 0.95 level it tried to conquer and settled back in the previous range below 0.9460. And the came RBA governor Glenn Stevens.

Stevens said that the Australian dollar is overvalued by most measures, and “by more than a few cents”. If this wasn’t enough, he said that investors are underestimating the risk of a sharp fall in A$ at some point. And the Aussie fell.

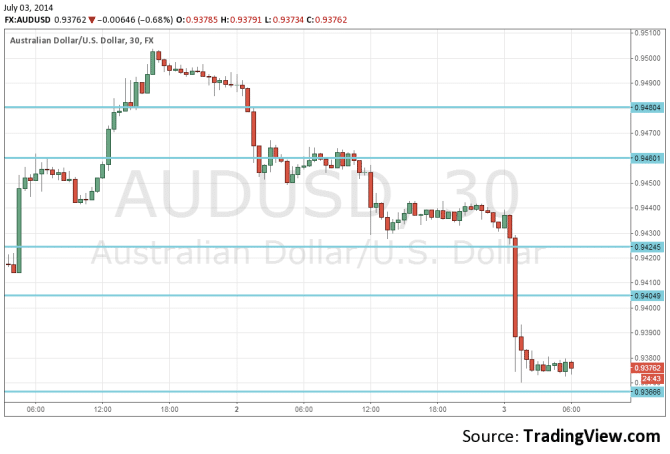

As the chart shows, AUD/USD went from trading around 0.9440 to 0.9380. This is more than a cent lower than around 0.95 and only 60 pips down, but it’s a start for “more than a few cents”:

At the same time, Stevens said he is “not trying to jawbone the Aussie lower” or something of that sort. It certainly seems he is. What he didn’t do is explicitly introduce a policy easing bias. That could be the next step if the Aussie remains on high ground.

In other Australian economic news retail sales for May disappointed with a drop of 0.5% instead of a flat read. Building approvals leaped by 9.9%, much better than 3.1% expected.

China’s official Non-Manufacturing PMI stands at 55 points, while the HSBC services PMI stands at 53.1 points. Both reflect growth in Australia’s No. 1 trading partner.

For more about the Aussie, see the AUDUSD prediction.