EUR/USD is listless on Thursday, as the pair trades in the mid-1.36 range in the European session. It’s a busy day on the release front, and traders can expect some movement from EUR/USD during the day. Eurozone and Spanish Services PMI softened, while Italian Services PMI improved. Eurozone Retail Sales dropped to a flat 0.0%, its worst showing in five months. Later in the day, the ECB will announce its benchmark interest rate, followed by a press conference hosted by ECB head Mario Draghi. In the US, employment data is the focus, with the releases of Nonfarm Payrolls, the Unemployment Rate and Unemployment Claims. As well, the US will release Trade Balance.

Here is a quick update on what’s moving the pair.

Update: Non-Farm Payrolls 288K in June, unemployment rate 6.1% – USD stronger

You can watch the live coverage of both events here from 11:30 GMT

- EUR/USD was steady in the Asian session and the lack of movement continues in European trading.

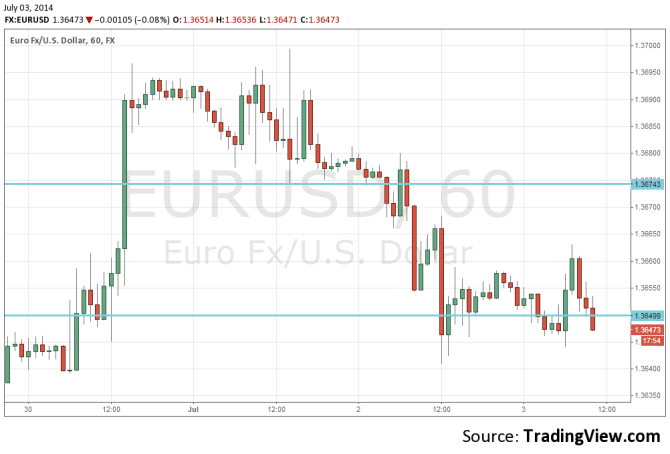

- Current range: 1.3650 to 1.3677

Further levels in both directions:

- Below: 1.3650, 1.3585, 1.3550, 1.35, 1.3450, and 1.34.

- Above: 1.3677, 1.37, 1.3740, 1.3785, 1.3830, 1.3865 and 1.3905.

- On the downside, 1.3650 is under strong pressure. 1.3585 follows.

- 1.3677 is an immediate resistance line. The round number of 1.37 is next.

EUR/USD Fundamentals

- 7:15 Spanish Services PMI. Estimate 56.3 points. Actual 54.8 points.

- 7:45 Italian Services PMI. Estimate 52.3 points. Actual 53.9 points.

- 8:00 Eurozone Final Services PMI. Estimate 52.8 points. Actual 52.8 points.

- 9:00 Eurozone Retail Sales. Estimate 0.3%. Actual 0.0%.

- 9:01: French 10-year Bond Auction. Actual 1.77%.

- 11:30 US Challenger Job Cuts.

- 11:45 Eurozone Minimum Bid Rate. Estimate 0.15%.

- 12:30 ECB Press Conference.

- 12:30 US Nonfarm Employment Change. Estimate 214K. See how to trade the NFP with GBP/USD

- 12:30 US Unemployment Claims. Estimate 314K.

- 12:30 US Unemployment Rate. Estimate 6.3%.

- 12:30 US Trade Balance. Estimate -45.1B.

- 12:30 US Average Hourly Earnings. Estimate 0.2%.

- 13:45 US Final Services PMI. Estimate 61.1 points.

- 14:00 US ISM Non-Manufacturing PMI. Estimate 56.2 points.

- 14:30 US Natural Gas Storage. Estimate 100B.

*All times are GMT.

For more events and lines, see the Euro to dollar forecast.

EUR/USD Sentiment

- Markets await ECB statement: Will the ECB take any dramatic action at its policy meeting later on Thursday? Most analysts are saying no, with the ECB expected to hold rates at the record low of 0.15% and maintain current monetary policy. At the June meeting, the ECB took unprecedented steps to combat low growth and inflation, including negative deposit rates. These measures were intended to boost inflation and growth levels, but that hasn’t occurred, at least not yet. This was reaffirmed with the release of Eurozone Retail Sales on Thursday, the primary gauge of consumer spending. The indicator dipped to 0.0%, shy of the estimate of 0.3%.

- US employment data in spotlight: In the US, ADP Nonfarm Payrolls was outstanding, soaring to 281 thousand, up from 179 thousand a month earlier. This crushed the estimate of 207 thousand. Will the official Nonfarm Payrolls follow suit? The markets are expecting a reading of 214 thousand, slightly below the May reading. The Unemployment Rate and Unemployment Claims are also expected to show little change. If there are any surprises from these key indicators, traders can expect some movement from EUR/USD during the day.

- Eurozone unemployment numbers improve: There was good news on Tuesday, as the Eurozone Unemployment Rate dipped to 11.6%, its lowest level in almost two years. This edged below the estimate of 11.7%. The strong reading could contribute to the ECB deciding to maintain current policy and not introduce a more accommodative monetary stance. At the June meeting, the ECB took unprecedented steps to combat low growth and inflation, including negative deposit rates. In Spain, the Unemployment Change posted an excellent reading, coming in at -122.7 thousand. This was shy of the estimate of -147.3 thousand. Spanish unemployment numbers tend to be very strong in the summer months due to the tourist season.

- German numbers slip: Weak German data continues to be a concern. The week started with Retail Sales, the primary gauge of consumer spending, posting its third straight decline. The indicator came in at -0.6% last month, well off the forecast of +0.8%. Unemployment Change, which had posted strong declines in the first quarter of the year, has reversed direction and recorded two straight gains, pointing to trouble in the employment sector. In June, the indicator came in at +9K, compared to an estimate of -9K. The euro is sensitive to German data, as Germany is the largest economy in the Eurozone.

- US releases improve after GDP: Last week’s US GDP release for Q1 was a disaster, as the economy contracted by a staggering 2.9% in Q1. However, the markets remained calm, and the US dollar escaped without much damage against most of its major rivals. More recent releases have been better, notably consumer confidence and housing data. Pending Home Sales jumped 6.1%, crushing the estimate of 1.4%. This was the strongest gain since May 2013. This reading followed New Home Sales and Existing Home Sales, which both beat their estimates.

Join a live coverage of the ECB and NFP action from 11:30 GMT