The Euro continued to struggle against a basket of currencies including the Japanese yen. The EURJPY failed on more than one occasion to break the 147.00-10 resistance area resulting in a move lower. The pair is currently testing an important support area and if the Euro sellers clear it, then more sustained losses are feasible in the near term. There were a few releases lined up today in the Euro zone, but it looks like they are rescheduled now. So, the probability of a larger move in the Euro pairs is less and most likely there will be ranging moves in the FX market.

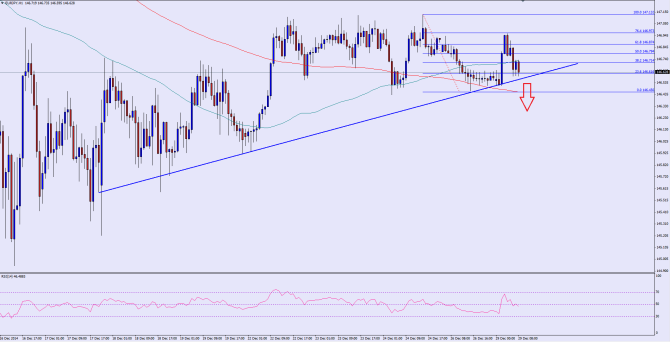

There is a bullish trend line formed on the hourly chart of the EURJPY pair, which might play an important role in the near term. We need to see how the pair trades in the coming sessions as it is currently testing the highlighted trend line. Recently, the pair climbed higher towards the 76.4% fib retracement level of the last leg from the 147.13 high to 146.45 low, but failed to break it. It is now trading below the 100 hour simple moving average. So, there are a lot of bearish signs on the hourly chart, which suggest that the pair might break the trend line and continue trading lower. The most important support below the trend line is around the 200 hour moving average.

Alternatively, if the EURJPY pair moves higher from the current levels, then it might find resistance around the 100 hour MA.

Overall, one might consider selling with a break below the highlighted trend line as long as the pair is below the 100 MA.

————————————-

Posted By Simon Ji of IKOFX