The New Zealand dollar had a terrible week, falling to multi-year lows on weak inflation and a stronger US dollar.After the pair finally broke out of range, is it set to continue falling or recover? A lot depends on the RBNZ. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Consumer prices fell by 0.2% in Q4, much worse than expected. This triggered a sell-off of the kiwi: the central bank is not expected to continue its tightening cycle anytime soon. In addition, the rate cut in Canada, another commodity based economy, even ignited expectations that the RBNZ could cut the high interest rate. Together with a surging US dollar partly on the back of the ECB QE program, NZD/USD certainly broke out of range, and to the downside, ignoring yet another rise in milk prices.

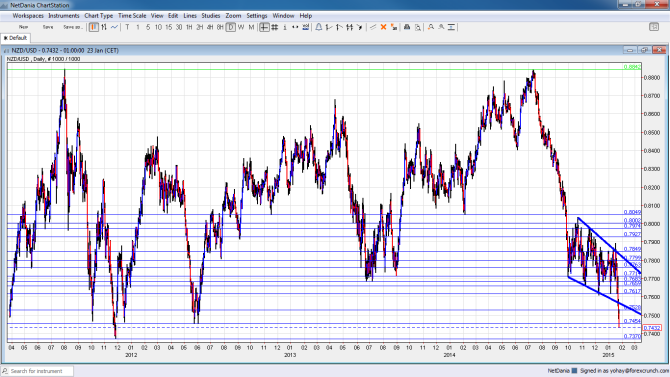

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Credit Card Spending: Monday, 2:00. With retail sales data published only once per quarter, these monthly updates about actual credit card spending provide an updated picture. Last month, spending came out at a gain of 5.2% year over year. A slower rise is predicted for December.

- Rate decision: Wednesday, 20:00. The RBNZ is expected to signal a longer pause to the tightening cycle it began in 2014 and that ended in July with the hike to 3.50%. Recent inflation numbers are weak. After the Bank of Canada surprised with a cut, a follow up move from Wheeler cannot be ruled out. However, the lower value of the kiwi could prompt them to wait before acting. The event is accompanied by a press conference.

- Trade Balance: Wednesday, 21:45. New Zealand’s trade deficit squeezed to 213 million in November, better than expected. Another drop to only 70 million is expected now. An outright surplus is also on the cards.

- Building Consents: Thursday, 21:45. The number of approvals leaped by 10% in November. While this is a very volatile indicator, it provides insights on the housing sector.

- Visitor Arrivals: Thursday, 21:45. Tourism also plays an important role in the local economy and it’s high season now. After a rise of 3.1% in December, a similar rise is likely for January.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started off the week struggling with 0.78 (mentioned last week). It then deteriorated quickly. An attempt to retake 0.7715 failed and the pair eventually close at very low levels: 0.7432.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

We start from lower ground this time. 0.80 is now key resistance on the upside. Just below, the old resistance line of 0.7975 is also relevant after capping the pair in October.

0.7930 was a double top in October’s recovery and is important to watch. It is followed by 0.7850.

0.78 is a round number and provided support various times, including recently. Going deeper, 0.7765 worked as support, and is a line to watch now on the way up.

0.7715 was stronger support after serving holding the pair in December. 0.7680 worked as support in December and that is where the pair stopped in early January 2015.

Below this point, we are back to levels last seen in 2012: 0.7615 is initial support and the critical line is 0.7460.

Further support is found at 0.7370, followed by the round number of 0.72.

Wide downtrend channel maintained

As the thick black lines show, the pair is trading within a wide channel that is heading down. The bottom of the channel was tested in December and held up very well.

I am neutral NZD/USD

The drop in CPI was a real game changer for the kiwi. If the RBNZ follows the BOC and cuts, we could certainly see more falls. However, if the status quo is maintained, we could see some stabilization after the huge falls.

In our latest podcast, we do an ECB QE rundown, SNBomb effect on brokers, surprise cut in Canada & Iranian oil:

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.