USD/CAD showed strong gains late on Friday, as the pair was up over 100 points last week. The pair closed at 1.2623. This week’s major event is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian dollar started the week with gains, as GDP rebounded with a gain of 0.3% in December. Late in the week, however, Building Permits and Trade Balance posting much sharper declines than expected. In the US, employment data was very strong, as the US gained 295 thousand jobs in February, beating expectations. The combination of events slammed the Canadian dollar, which suffered sharp losses on Friday.

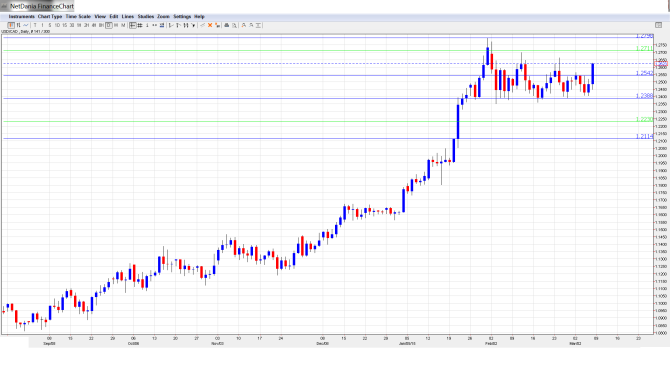

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Housing Starts: Monday, 12:15. This minor event improved to 187 thousand in January, slightly above the estimate of 184 thousand. Will the upward trend continue in the February report?

- NHPI: Thursday, 12:30. The New Housing Price Index helps gauge activity in the housing sector. The indicator has been very steady, with four straight readings of 0.1%. During that time, the estimates stood at 0.2%. Little change is expected in the January report.

- Employment Change: Friday, 12:30. Employment Change is the highlight of the week and can have a significant impact on the movement of USD/CAD. The January report jumped to 35.4 thousand, marking a 3-month high. This excellent reading crushed the forecast of 4.7 thousand. Will the indicator repeat with another strong performance? The Unemployment Rate has been very steady, with three consecutive readings of 6.6%. The forecast for the upcoming reading stands at 6.5%.

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2515 and dropped to a low of 1.2405, as support held at 1.2387 (discussed last week). The pair then reversed directions and climbed to a high of 1.2627. USD/CAD closed the week at the 1.2623.

Live chart of USD/CAD:

[do action=”tradingviews” pair=”USDCAD” interval=”60″/]Technical lines, from top to bottom

We start with resistance at 1.3063, slightly above the symbolic line at the round number of 1.30.

1.2924 was last tested in March 2009.

1.2798 is next. This marked the high point in January, in which the pair gained a spectacular 11 cents.

1.2711 is the next line of resistance.

1.2541 continued to see action last week. The line has reverted to a support level following the gains by USD/CAD late in the week.

1.2387 has strengthened as a support level.

1.2230 is the next support line.

1.2114 is the final support line for now. This line switched to a support role late January when the US dollar started a strong rally.

I remain bullish on USD/CAD

The Canadian dollar continues to lose ground to its US counterpart, and this trend could continue. US employment numbers are back on a roll, although there is concern about the lack of wage growth. Unless Canadian employment data is very strong this week, the loonie will be hard pressed not to fall further against the greenback.

In the fresh podcast, we talk about the US economy, the Australian and Canadian rate decisions, a potential easing in Japan, the widening gap within oil prices and an update on forex brokers after the SNBomb

Follow us on the iTunes page

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.