The question in the title is asked by many: since EUR/USD dipped below 1.05 it has made its way above 1.10, but couldn’t stay there either.

The team at Nordea examines the pair and seeks answers:

Here is their view, courtesy of eFXnews:

The EUR/USD reacted to the ECB QE launch as anticipated, and bounced. The “policy divergence” theme is in question as increasing volatility suggests indecision – and potential for further upward correction in the near term. If the pair reaches 1.1450, we may have to revise our forecasts, which see 1.05 at end 2015.

Squeeze on!

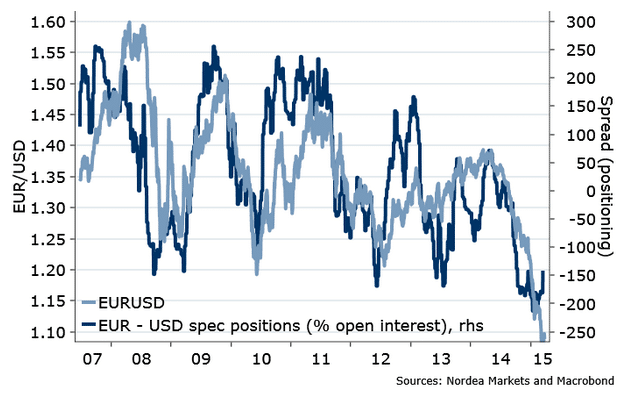

After a relentless fall, EURUSD was finally squeezed during the recent FOMC meeting. This was no news: the EUR has copied the exact JPY reaction after the BoJ announced QQE back in April 2013. This implies a EURUSD correction to 1.12 in the near term. Will that be it? If you look at EURUSD daily volatility, the range has widened over the past year, from just +/- 0.5% to now +/- 1.5%. This implies that market participants are nervous. It comes as no surprise: the CFTC data suggests the positioning is still very much extreme: the USD net long positions are 1.5 standard deviations above historic mean, while the EUR net short positions are 4 above historic mean. This is a historic extreme.

Figure 1. Room for a further squeeze up?

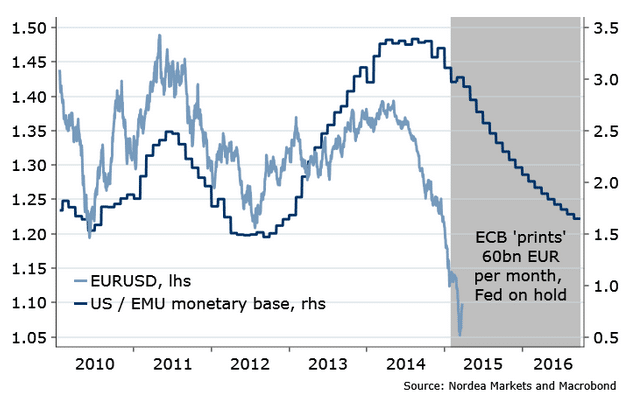

The Draghi show is over.

Applause! It seems that the ECB QE effect on the EURUSD has played out. It was a typical “sell on rumour, buy on fact” reaction. The market has ran a little ahead of itself, bringing the EURUSD much lower than the ECB / Fed relative balance sheet would have implied.

Figure 2. ECB QE priced in?

“Policy divergence” as a theme dominated in the H2 last year, and many extrapolated it into 2015. But with the relative economic growth converging (the Euro zone is now very likely to record faster growth in Q1 than the US!), the “policy divergence” theme loses its shine. While the Fed is priced to hike in December this year, ECB is expected to be on hold until 2018. Big gap. It is important to note that Draghi has changed his tone recently. He sounds now more upbeat on the economic data – the cyclical improvement we are seeing in the sentiment, survey, retail sales data. A similar change in tone last year in April / May, from the positive to negative, marked the start of the downturn in the EURUSD.

The ball is in the Fed’s court.

While there has been a lot of focus on Fed’s first interest rate hike as of late, it becomes clear now that the path rather than the single point matters more for the EURUSD outlook. The Fed has cut it’s median dot Fed funds path by more than 0.5% points across the horizon, aligning it with the official Nordea’s view. So essentially now the Fed would need to bump the projection higher in order to give a further boost to the USD. That is unlikely to happen until the wage growth pick ups.

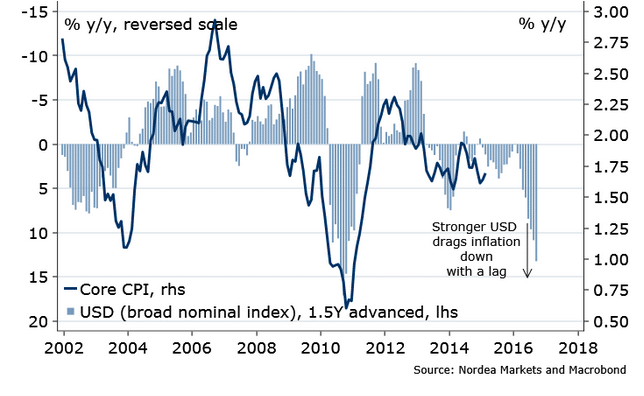

USD has become the key of the Fed policy focus lately – essentially every Fed member has mentioned it over the past month. The concern is the slowdown in the export market, which we haven’t seen materialise fully as of yet. More importantly, the core inflation, which has been resilient so far, may still slow down in the coming quarters on the USD strength alone.

Figure 3. Downside pressure on core inflation from USD

Above 1.1450 – trend change, below 1.0450 – parity

All in all, it seems the market narrative about the strong US economy and bad Euro zone economy is questioned at the moment. There is thus reason to question the market pricing for the Fed and ECB. Caveat: if the US data keeps disappointing in Q2, and the rest of the world “catches down”, this would raise fears of recession, and the USD will ultimately benefit much more, as the market participants will chase the still high yielding US Treasuries. But this is not our projection as of now.

Short term, a run toward 1.1450 is likely. And only once / if above, we will have to reconsider our call of a lower EURUSD going forward. Alternatively, a move below 1.0450 in the near term will signal the parity within reach.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.