As we have already mentioned, bond yields have a material impact on EUR/USD lately, with the shifts favoring the euro so far.

Will this continue or will it change? The team at Deutsche Bank weighs in:

Here is their view, courtesy of eFXnews:

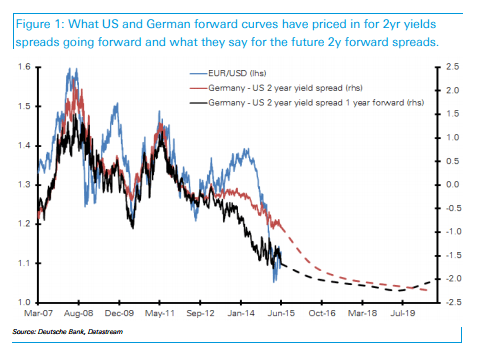

“There is considerable statistical evidence that the 2 year USD – EUR spread is set to take over from the 10yr spread as the key driver of EUR/USD.

Quantitative work is consistent with a very rough rule of thumb that 100bp shift in the 2y spread in favor of the USD is equal to 10 big figures on EUR/USD.

Forward rates point to an 2y spread adjustment in favor of the USD of 120bps in the next 3 years, enough to be consistent with EUR/USD heading to parity. Greater policy divergence than is priced in by the forwards is likely.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.