EUR/USD is on a roll, hitting very high resistance and screaming higher in general. Is it still a buy opportunity?

The team at Credit Agricole asks this question and provides a clear answer, one that appears in the headline. Here is their reasoning:

Here is their view, courtesy of eFXnews:

We advise against buying the EUR around the current levels.

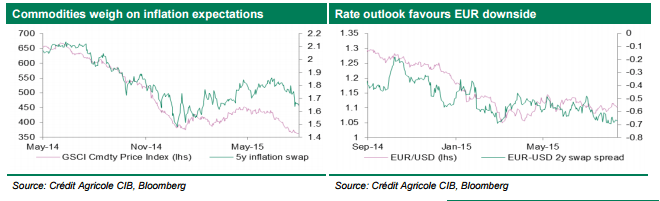

With speculative short positioning now less elevated, the currency should become more sensitive to monetary policy prospects. Weak commodity price developments and still muted growth momentum should have increased downside risks to inflation for the Eurozone as a whole. This is especially true as medium-term inflation expectations, as measured by 5y inflation swaps have fallen back to multi-month lows.

Considering that the EUR itself is regarded as an important driver of inflation expectations, the currency’s resilience over the past few weeks is unlikely to be welcomed by the ECB.

In terms of data, next week’s focus will be on the German IFO business climate survey, which should confirm capped growth expectations. This is especially true as external demand expectations related to China should have become more muted.

As a result, we remain in favour of selling EUR rallies, for instance against the USD, which should benefit from the increasing likelihood of the Fed considering higher rates in September.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.