The Fed decision is getting closer and among the 4 scenarios we have some balancing ones: a dovish hike or a hint instead of one.

The team at Credit Suisse lay out their preview and the implications for the US dollar.

Here is their view, courtesy of eFXnews:

Credit Suisse’ central view for the September 16-17 FOMC meeting is for no hike, and that we may see forward guidance hinting that a hike is being considered for the October or December meetings.

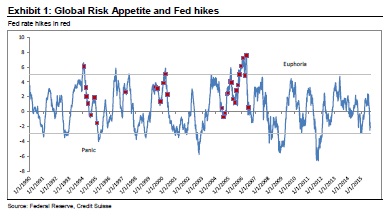

“This week is considered a close call though. If domestic data alone were the issue, we’d be inclined to lift off in September. But the timing of policy lift-off has become largely contingent on global conditions and financial market volatility, and in their view, these have combined to more than offset the good domestic news,” CS argues.

“As a result, the balance has tipped towards no rate hike on September 17. Our baseline forecast assumes a December 16 lift-off,” CS adds.

Market Implications:

“In rates, we expect no hike in September and a statement with guidance toward October or December lift-off to translate into higher front-end rates and a flatter real curve. We favor expressing this via shorting EDM6 and maintain our 5s30s real rate flattener recommendation,” CS projects.

“In FX, We remain bullish on the USD. While an FOMC decision with no hike and no signal of upcoming tightening could cause the USD to temporarily lose some ground against other G10 currencies, we think the poor growth outlook in the EM world would make any USD sell-offs short lived, in our view. We remain broadly long USD in our portfolio,” CS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.